If you’re considering a health reimbursement arrangement (HRA) for your business, something to consider is how the HRA interacts with the premium tax credit (PTC) of your employees. Today, let’s look at how the individual coverage HRA, or ICHRA, and premium tax credits work as well as how ICHRA affordability is calculated, and how premium tax credits work with QSEHRA.

ICHRA and QSEHRA with Premium Tax Credits: What to know

This post covers:

- What is a premium tax credit?

- How ICHRA works with premium tax credits

- How affordability is calculated for ICHRA

- How QSEHRA works with premium tax credits

What is a Premium Tax Credit?

First, a refresher.

Premium tax credits (PTCs) are tax credits that help individuals and their families purchase health insurance coverage through the Exchange. The premium tax credit is not available to plans purchased outside of the Exchange.

The credit is calculated from annual income and reduces the out of pocket expense for qualified individuals.

When individuals enroll in an Exchange plan, the Exchange will ask if the individual is offered any coverage through their employer.

This includes coverage through the ICHRA. Employees will be required to give notice to the Exchange of their ICHRA offering.

How ICHRA works with Premium Tax Credits 2025

Premium tax credits are based on income and insurance affordability. The IRS has set guidelines for determining eligibility for the premium tax credit and the size of the tax credit.

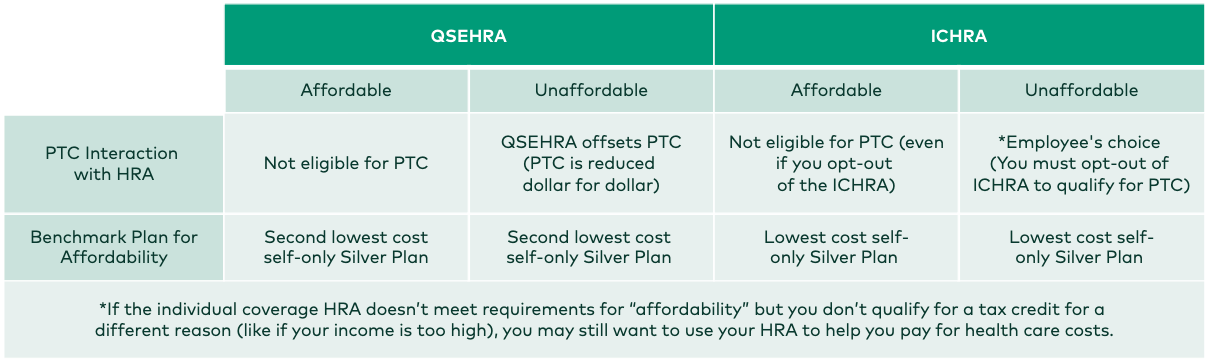

If an ICHRA is deemed affordable, employees must choose their HRA over a premium tax credit.

A nice feature of an ICHRA plan is that if an ICHRA is deemed unaffordable, employees have the option to participate in ICHRA or opt-out annually. This is different than the QSEHRA, which does not allow employees to opt-out.

Have questions about premium tax credits and HRAs?

Let's play out a real life example. Say you're using an ICHRA to reimburse your nanny for health insurance. If your nanny accepts the ICHRA they cannot claim any premium tax credits for the year for either themselves or any family members.

If the nanny opts-out of the ICHRA for the year they may be able to claim premium tax credits, if they are eligible in the first place.

ICHRA affordability 2025

The next step is to determine whether the ICHRA offered is deemed affordable or unaffordable for the employee. In cases where the employee has opted out of ICHRA and the HRA is considered unaffordable the employee is allowed to claim premium tax credits for themselves and dependents.

In cases where the employee has opted out of ICHRA and the coverage is deemed affordable the employee may not claim any premium tax credits for themselves or dependents.

Let’s take a closer look at ICHRA affordability, shall we?

The affordability threshold, which directly affects employers' potential liability for ACA shared-responsibility penalties, is adjusted each year based on health plan premium growth relative to income growth, using national health expenditure data from the Centers for Medicare & Medicaid Services (CMS).

How is affordability calculated?

Let's go through how ICHRA affordability is calculated.

ICHRA is considered affordable if the remaining amount an employee must pay for a self-only silver plan on the exchange does not exceed 9.02% of an employee's income for 2025.

- What is the lowest cost silver plan?

The lowest cost silver plan in a certain area is determined by the employee’s primary residence. - How is employee household income calculated?

Determining the employee household income is based on information provided on Box 1 of the employee’s W-2 form. The rate of pay is determined with the assumption that the employee works at least 130 hours per month. Lastly, if it is affordable at the Federal Poverty Level, then the plan is affordable.

Ask us how your local insurance market works for ICHRA!

ICHRA Affordability and premium tax credits

Large employers have to offer “affordable” ICHRAs if they want to satisfy the corporate mandate, but what about small employers (typically under 50 employees) not subject to the mandate?

Affordability is still important for small employers because it impacts the ability for employees to secure premium tax credits (PTC) (aka Obamacare subsidies) to help pay for their premiums:

- If an ICHRA is “affordable”, employees are not eligible for tax credits (PTC)

- If an ICHRA is “unaffordable”, employees can choose either the ICHRA or tax credits (PTC)

QSEHRA and Premium Tax Credits

For QSEHRAs, employers often find that their contributions are simply offsetting the PTCs their employees would receive anyway, dollar for dollar. In fact, almost 20% of employers who decided not to use QSEHRA cited the issue of PTCs as the reason.

In general, QSEHRAs reduce employees premium tax credits dollar for dollar. Basically the employee will be exchanging the tax benefit from the government with the tax benefit from the employer. The employee may still access their tax credits if the benefit is less than the premium tax credit (PTC) available to them.

Still have questions about premium tax credits and how they work with ICHRA and QSEHRA?

Does this sound confusing? Don't worry. The right HRA administrator is here to make your life easier. Do you need to check affordability for your company? We've created a new affordability calculator that can walk you through it.

Piece of cake!

Additional resources →

- Learn about ICHRA Rules

- Learn about ICHRA Tax Benefits

- Learn about ICHRA Classes

- Learn about Premium Tax Credits and ICHRA and QSEHRA

- Learn about ICHRA Requirements

- Learn about ICHRA Regulations

- Learn about ICHRA Plan FAQs

- Learn about our ICHRA administration platform

This post was originally published in 2021 and has been updated in 2025 to reflect new affordability rates set forth by the IRS.

Let's talk through your HRA questions

A wife to one and mother to four, Keely does all of the things. She’s also dabbled in personal finance blogging and social media management, contributed to MetroFamily magazine, and is passionate about good food, treasure hunting and upcycling. With a B.S. in Psychology from the University of Oklahoma and a knack for a witty punchline, it’s no surprise that Keely’s social posts are as clever as they get. In her (very little) free time, you’ll find Keely with her nose in a book or trying out a local restaurant with her family.