Overview

Small Business Health Insurance in Colorado: What to know

Hello, Colorado business owners! We understand that taking care of your employees' health is one of your top priorities. But let's face it, navigating the world of small business health insurance in Colorado can be complex, especially with so many options available out there. You want to provide the best care for your team, but you also need to consider costs and administrative ease. Finding affordable Colorado health insurance that works for your team can feel a bit overwhelming, can't it?

But don't worry, you're not alone. We're here to help! This Small Business Health Insurance Colorado Guide aims to simplify the process and help you understand your options, with a particular emphasis on Health Reimbursement Arrangements, or HRAs. HRAs have been growing in popularity among businesses in The Centennial State, and for good reasons!

Stick with us as we delve into the ins and outs of HRAs, explore how they compare to other health benefits options in Colorado, and discover why they might just be the perfect solution for your business. It's all about equipping you with the knowledge to make an informed decision that suits your company and, most importantly, supports your employees' wellbeing.

So, let's embark on this journey together to find the best health benefits solution for your Colorado business.

This guide covers:

- The choices Colorado small businesses have for health insuranc

- The pros and cons of each health insurance option for Colorado small businesses

- Why Colorado businesses are a good fit for health reimbursement arrangements

- What requirements there are for Colorado Small Businesses

- A case study of how one Colorado Small Business benefited from their HRA from Take Command

- How to get started offering an HRA to your business

Small Business Health Insurance Colorado Guide Table of Contents

- Overview

- Small Business Health Insurance in Colorado: What to Know

- Navigating Colorado Health Insurance for Companies

- Options for Colorado Small Business Health Insurance

- Group Health Insurance for Colorado Small Businesses

- Health Maintenance Organizations (HMOs)

- Preferred Provider Organizations (PPOs)

- Exclusive Provider Organizations (EPOs)

- Point of Service Plans (POS)

- Self-funded Health Plans

- Health Sharing Plans

- HSAs (Health Savings Accounts)

- Direct Primary Care

- The Best Option for Colorado Small Businesses: HRAs

- Why Health Reimbursement Arrangements: A Colorado Small Business Win

- Side-by-Side Comparison: ICHRAs vs. QSEHRAs

- Health Benefits Environment in Colorado

- Unlocking the Power of Colorado's Health Benefits Marketplace

- Colorado Small Business Health Insurance Requirements

- Do small businesses have to offer health insurance in Colorado?

- Why Individual Coverage HRAs are a Perfect Fit for Colorado's Health Insurance

- Landscape

- Case Study: An ICHRA Success Story,

- Snarf's Sandwiches

- Showcasing Colorado Health Insurance Companies that Integrate with ICHRA

- Why HRAs Stand Out for Colorado Businesses

- Flexibility and Customization

- Employee Choice

- Cost Efficiency

- Compatibility with Premium Tax Credits

- Simplicity and Ease of Use

- Capitalizing on Colorado's Individual Health Insurance Plans with HRAs

- Discovering the HRA Advantage for Colorado Businesses

- Harnessing the Take Command Advantage for Colorado Small Business Health Insurance

- The Road Ahead: Embracing Colorado's Health Benefits Landscape

- FAQs For Colorado Small Business Health Insurance

- How much does small business health insurance cost in Colorado?

- What administrative requirements do I have as a Colorado employer if I want to offer an HRA?

- What expenses are not eligible for HRA Reimbursement?

- Let's talk through your HRA questions.

Which HRA is right for you?

Navigating Colorado Health Insurance for Companies

According to Kaiser Family Foundation, roughly half of small businesses offer health insurance to their employees (and that number keeps dropping).

Remember, employee benefits aren't just important to ensure that your team is happy and healthy, if you fail to offer competitive benefits, it can bring some serious consequences to your small business.

These might include:

- Financial consequences of hiring and training new hires.

- Risk of losing employees you depend on (and information and ideas) to competitors.

- Crushing workloads from being understaffed.

- Hours lost in recruitment and training for new hires.

Options for Colorado Small Business Health Insurance

When evaluating health benefits for your Colorado small business, it's important to take into account a few factors that will ultimately direct which option is best for your company.

- your budget

- your bandwidth

- how your company is set up

- your location (i.e., how individual and group plan costs vary in your geographic area)

And good news - Colorado has one of the most competitive individual health insurance markets in the country.

Now let's jump into your actual options for health benefits for Colorado small businesses. And fear not, you have several options! Although we will be the first to say that some options are better than others.

Let's get to it.

Here are your options for small business health insurance in Colorado:

Your first option is doing nothing. If you have less than 50 employees, you aren't actually required to offer benefits at all. Do we advise this? No. How are you going to recruit and retain talent to support your amazing business idea without competitive benefits?

Ok, moving right along.

Group health insurance for Colorado Small Businesses

Historically speaking, small business group health insurance—or fully funded insurance—has been the primary option for many small employers looking to offer health benefits for their employees. It's also referred to as corporate health insurance or group health insurance and sometimes includes vision and dental insurance for small businesses if it's included in the plan.

It is geared toward businesses with less than 50 full-time employees everywhere except four states, where it applies to businesses with up to 10 employees.

The upside? These ACA-compliant plans are well-known, tax-free, have solid product options, and have proven effective retention strategies. Coverage is generally guaranteed; anyone who applies and meets the criteria will be accepted to the program.

Purchase of a SHOP plan may qualify the buyer for the Small Business Health Care Tax Credit.

And yes, there's a downside.

The shortcomings can be detrimental to small business budgets; small group plans are expensive, one-size-fits-all, with unpredictable premium increases year over year and participation rate requirements.

Health Maintenance Organizations (HMOs)

For small businesses in Colorado, Health Maintenance Organizations (HMOs) offer a network-based health insurance option that typically requires members to choose a primary care physician (PCP) who coordinates all healthcare services. This coordination is beneficial for ensuring that care is administered efficiently. HMO plans often require referrals from the PCP to see specialists, which helps manage healthcare costs but can limit flexibility. These plans are well-suited for small business health insurance in Colorado due to their typically lower premiums than other plan types.

Preferred Provider Organizations (PPOs)

Preferred Provider Organizations (PPOs) provide more flexibility than HMOs and are popular among Colorado small businesses. These plans allow employees to visit any healthcare provider without requiring a referral, including out-of-network providers, although at a higher cost. The increased flexibility makes PPOs a preferred choice for businesses that want to offer their employees more control over their healthcare choices, fitting well with the diverse needs of a growing company.

Executive Provider Organizations (EPOs)

Exclusive Provider Organizations (EPOs) combine elements of HMOs and PPOs but generally do not cover out-of-network care unless it's an emergency. This plan is advantageous for small-group health insurance in Colorado as it often results in lower monthly premiums. EPOs are suitable for businesses whose employees do not need frequent services from out-of-network providers and prefer the simplicity and lower costs associated with in-network-only care.

Point of Service Plans (POS)

Point of Service (POS) plans offer HMO and PPO features. Like HMOs, members typically need to designate a primary care physician and get referrals to see specialists. However, like PPOs, POS plans offer the flexibility to go out-of-network at a higher cost. This plan is ideal for Colorado small businesses looking for a balance between cost savings and flexibility, allowing employees to make more personalized healthcare decisions with guidance from their PCP.

Self-funded Health Plans

Technically speaking, self-insured employers pay for claims out of pocket when they arise instead of paying a predetermined premium to a carrier for a small group plan.

This type of plan, also known as a self-insured plan, is usually seen with a large enterprise as a means to control their healthcare spend and manage their risk pool.

The benefits of this type of plan are that it's more customizable to your workforce, you have control over the health plan reserves so you can maximize your interest income, it’s more affordable per enrolled employee than a traditional plan, there's no pre-funding of health coverage, and you aren't subject to state health insurance premium taxes (usually around 2 to 3%).

They’re also subject to fewer regulations and allow employers to customize their healthcare plan to meet their unique business needs.

And because companies are paying only for the healthcare costs of their own employees, there may be money left over at the end of the year that can go toward other business needs.

Self-funded plans, while ideal for some types of companies, really aren't fit for small companies.

While self-funded plans allow the company to potentially save the profit margin that an insurance carrier adds to its premium, the potential risk is much higher since the company is responsible for paying out the actual claims—especially in the event of catastrophic claims which could potentially bankrupt a company.

Risk is inherent to any small business, but adding risk from a self-funded plan is not the type of risk you want to take.

Health Sharing Plans

Health sharing plans are a cooperative approach to managing healthcare expenses that can be an alternative to traditional health insurance. These plans involve a community of individuals who share similar ethical or religious beliefs and agree to help each other cover their medical expenses. While not insurance in the traditional sense, health-sharing plans often function similarly by collecting monthly shares that are then allocated to members' eligible medical expenses. These plans can be particularly appealing for small businesses in Colorado that might find traditional small-group health insurance too costly or those seeking a more community-oriented approach to healthcare.

Health Savings Account (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged savings accounts designed to help individuals with high-deductible health plans (HDHPs) manage their out-of-pocket medical expenses. Contributions to an HSA are tax-deductible, the earnings grow tax-free, and withdrawals for qualified medical expenses are tax-exempt. For small businesses in Colorado, offering HSAs can be a way to provide valuable health benefits to employees, encouraging them to save for future healthcare needs while reducing their taxable income. HSAs are especially beneficial in conjunction with HDHPs, providing a financial cushion for healthcare expenses.

Direct Primary Care

Direct Primary Care (DPC) is an innovative healthcare model that simplifies delivery of primary care. Unlike traditional health plans, DPC involves a flat monthly fee that patients pay directly to the healthcare provider, covering all or most primary care services including consultations, visits, and routine examinations. This model eliminates the need for insurance billing and often provides patients more personalized and accessible care. For Colorado small businesses, incorporating DPC into their healthcare options can lead to more predictable healthcare costs and improved employee satisfaction with their healthcare services.

The Best Option for Colorado Small Businesses: HRAs

For small businesses in Colorado, Health Reimbursement Arrangements (HRAs) stand out as one of the most flexible and cost-effective options for managing employee health benefits. Particularly in the context of Colorado's diverse economic landscape, from bustling urban centers like Denver to smaller towns and rural areas, HRAs offer versatility that can meet a variety of business needs and employee circumstances.

Flexibility and Customization

HRAs are especially advantageous for small businesses because they allow for significant customization. Employers can decide how much money to allocate to each employee and which health expenses are eligible for reimbursement. This flexibility makes HRAs an attractive option for small group health insurance in Colorado, where businesses might have employees with varying health care needs and preferences.

Cost Control

Another significant benefit of HRAs is the control they offer over healthcare spending. Unlike traditional health insurance policies, where premiums can be high and unpredictable, HRAs allow small businesses to set fixed budgets for their employees’ health care contributions. This can be particularly beneficial for small business health insurance in Colorado, helping businesses manage their budgets more effectively while still offering substantial health benefits.

Benefits for Diverse Workforce Needs

HRAs can be tailored to support traditional employees, part-time workers, and remote workers, including those who might be out of state. This adaptability makes HRAs a practical solution for Colorado group health insurance, accommodating the varying needs of a geographically dispersed or diverse workforce.

Tax Advantages

The tax benefits associated with HRAs are significant. Contributions made by employers are tax-deductible, and reimbursements received by employees are tax-free if they are for qualified medical expenses. This is a compelling reason for choosing HRAs, as it provides financial benefits to both parties involved.

Wondering how you could design your HRA?

Why Health Reimbursement Arrangements

First off, let's demystify Health Reimbursement Arrangements (HRAs). An HRA is a type of employer-funded health benefit plan that reimburses employees for out-of-pocket medical expenses and, in some cases, health insurance premiums. It provides businesses with a flexible, cost-effective way to offer health benefits, and it's all tax-free!

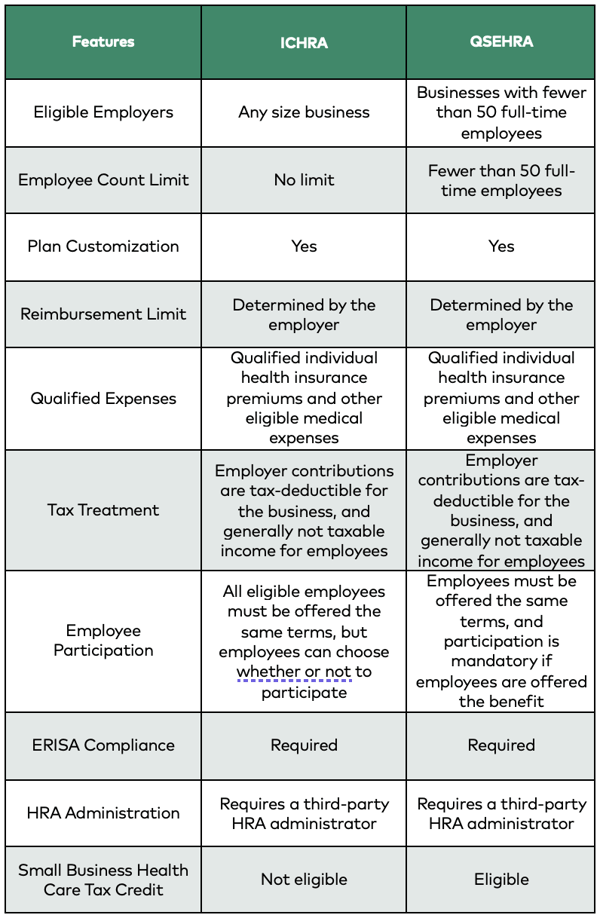

Two of the most common types of HRAs are the Individual Coverage HRA (ICHRA) and the Qualified Small Employer HRA (QSEHRA).

ICHRA allows businesses of any size to reimburse their employees for individual health insurance premiums and medical expenses. The key perk? There's no maximum contribution limit, and businesses can offer different allowances to different employee classes, adding an extra layer of flexibility.

On the other hand, QSEHRA is specifically designed for small businesses with fewer than 50 employees. This type of HRA also allows for reimbursement of individual insurance premiums and medical expenses, but it does have annual contribution limits set by the IRS. In 2023, the QSEHRA limit is $5,450 for self-only employees and $11,050 for employees with a family.

So why are health benefits so important? Well, they're a crucial part of any compensation package, helping to attract and retain top talent. Plus, they can improve employee health and productivity, and even reduce healthcare costs in the long run.

Side-by-Side Comparison: ICHRAs vs. QSEHRAs

Navigating the world of HRAs can be a bit overwhelming, especially when it comes to understanding the differences between ICHRAs and QSEHRAs. To make things easier, let's take a closer look at these two popular HRA options in a side-by-side comparison. From eligibility criteria to plan customization and tax treatment, this comparison will help you make an informed decision about which HRA is the best fit for your business and employees. Let's dive in and explore the unique features of ICHRAs and QSEHRAs.

Health Benefits Environment in Colorado

The state of Colorado boasts a well-structured and comprehensive health benefits landscape, with a variety of programs designed to provide residents with access to the healthcare services they need. A key starting point for many is Colorado PEAK, an online portal that serves as a gateway to numerous state-provided benefits, such as Health First Colorado, the state's Medicaid program, and Child Health Plan Plus.

Health First Colorado offers a broad spectrum of health coverage to eligible individuals and families, encompassing services like doctor visits, hospital stays, and prescription medications. For those who don't qualify for Medicaid but still find private insurance out of reach, the Child Health Plan Plus steps in to provide health coverage to children and pregnant women.

In addition to these, Colorado residents have a plethora of health benefits at their disposal. This includes medical insurance that covers an array of services from routine doctor visits to more extensive treatments, dental insurance for routine cleanings to more complex dental procedures, and vision insurance to help with eye exams, glasses, and contact lenses.

The landscape of health benefits in Colorado has evolved over time, significantly impacted by new federal requirements introduced in 2014. These mandated that health insurance plans offer more comprehensive coverage, referred to as Essential Health Benefits or EHBs. EHBs include a minimum set of benefits and services that must be included in health plans, though plans are free to offer more benefits as needed. This progression ensures that residents are provided with a baseline of crucial health services, regardless of the specific insurance plan they choose.

Colorado's health benefits landscape is rich and varied, offering residents numerous options to meet their healthcare needs and ensure their wellbeing.

Unlocking the Power of Colorado's Health Benefits Marketplace

Let's talk about why having a robust individual health insurance marketplace is a big deal when it comes to offering Health Reimbursement Arrangements (HRAs) as a health benefits solution. Picture this: a marketplace filled to the brim with options, where employees can choose the insurance plan that fits them like a glove. Well, Colorado's health benefits landscape delivers just that.

Colorado PEAK is where the magic begins. It's an online portal that opens the doors to a plethora of state-provided benefits, including Health First Colorado (the state's Medicaid program) and Child Health Plan Plus. These programs make sure eligible individuals and families get the coverage they need, from doctor visits to prescriptions. No one's left behind, because even those who don't qualify for Medicaid can turn to the Child Health Plan Plus for support.

But that's not all. Colorado residents have a treasure trove of health benefits at their fingertips. We're talking medical insurance that covers everything from routine check-ups to serious treatments, dental insurance that keeps those pearly whites in top shape, and vision insurance to ensure clear sight and stylish frames.

Hold on, we're not done yet. In 2014, federal requirements stepped in and shook things up. They introduced Essential Health Benefits (EHBs), which are like the basic package of must-have health services. Every plan has to include these essentials, but carriers can go the extra mile and offer even more benefits.

So, why does all of this matter? Well, a strong individual health insurance marketplace in Colorado means employees have a world of options. It empowers them to choose a plan that suits their unique needs, and that's where HRAs come in. With HRAs, employers can pair their contributions with the employee's selected plan, creating a personalized benefits package that puts a smile on everyone's face.

So, let's celebrate Colorado's vibrant health benefits marketplace, where choices abound and employees can find the coverage that's just right for them. It's the perfect foundation for unlocking the power of HRAs and revolutionizing your company's health benefits strategy.

Colorado Small Business Health Insurance Requirements

As a small business owner, you may find yourself pondering the question, "Am I obligated to provide health insurance to my employees?" Well, let's dive into the details.

According to the Affordable Care Act (ACA), also known as "Obamacare," applicable large employers (ALEs) with 50 or more full-time equivalent employees (FTEs) must offer affordable health benefits that meet the minimum essential coverage (MEC) requirements. Failure to do so may result in penalties for these larger businesses.

Do small businesses have to offer health insurance in Colorado?

Good news! Small businesses are not bound by the same obligations to provide insurance to their employees. So, take a breath and know that you have some flexibility in this realm.

See how you can save in Colorado

Navigating Colorado Health Insurance for Companies

According to Kaiser Family Foundation, roughly half of small businesses offer health insurance to their employees (and that number keeps dropping).

Remember, employee benefits aren't just important to ensure that your team is happy and healthy, if you fail to offer competitive benefits, it can bring some serious consequences to your small business.

These might include:

- Financial consequences of hiring and training new hires.

- Risk of losing employees you depend on (and information and ideas) to competitors.

- Crushing workloads from being understaffed.

- Hours lost in recruitment and training for new hires.

Options for Colorado Small Business Health Insurance

When evaluating health benefits for your Colorado small business, it's important to take into account a few factors that will ultimately direct which option is best for your company.

- Your budget

- Your bandwidth

- How your company is set up

- Your location (i.e., how individual and group plan costs vary in your geographic area)

And good news - Colorado has one of the most competitive individual health insurance markets in the country.

Now let's jump into your actual options for health benefits for Colorado small businesses. And fear not, you have several options! Although we will be the first to say that some options are better than others.

Let's get to it.

Here are your options for small business health insurance in Colorado

Your first option is doing nothing. If you have less than 50 employees, you aren't actually required to offer benefits at all. Do we advise this? No. How are you going to recruit and retain talent to support your amazing business idea without competitive benefits?

Ok, moving right along.

Group health insurance for Colorado Small Businesses

Historically speaking, small business group health insurance—or fully funded insurance—has been the primary option for many small employers looking to offer health benefits for their employees. It's also referred to as corporate health insurance or group health insurance and sometimes includes vision and dental insurance for small businesses if it's included in the plan.

It is geared toward businesses with less than 50 full-time employees everywhere except four states, where it applies to businesses with up to 10 employees.

The upside? These ACA-compliant plans are well-known, tax-free, have solid product options, and have proven effective retention strategies. Coverage is generally guaranteed; anyone who applies and meets the criteria will be accepted to the program.

Purchase of a SHOP plan may qualify the buyer for the Small Business Health Care Tax Credit.

And yes, there's a downside.

The shortcomings can be detrimental to small business budgets; small group plans are expensive, one-size-fits-all, with unpredictable premium increases year over year and participation rate requirements.

Health Maintenance Organizations (HMOs)

For small businesses in Colorado, Health Maintenance Organizations (HMOs) offer a network-based health insurance option that typically requires members to choose a primary care physician (PCP) who coordinates all healthcare services. This coordination is beneficial for ensuring that care is administered efficiently. HMO plans often require referrals from the PCP to see specialists, which helps manage healthcare costs but can limit flexibility. These plans are well-suited for small business health insurance in Colorado due to their typically lower premiums than other plan types.

Preferred Provider Organizations (PPOs)

Preferred Provider Organizations (PPOs) provide more flexibility than HMOs and are popular among Colorado small businesses. These plans allow employees to visit any healthcare provider without requiring a referral, including out-of-network providers, although at a higher cost. The increased flexibility makes PPOs a preferred choice for businesses that want to offer their employees more control over their healthcare choices, fitting well with the diverse needs of a growing company.

Exclusive Provider Organizations (EPOs)

Exclusive Provider Organizations (EPOs) combine elements of HMOs and PPOs but generally do not cover out-of-network care unless it's an emergency. This plan is advantageous for small-group health insurance in Colorado as it often results in lower monthly premiums. EPOs are suitable for businesses whose employees do not need frequent services from out-of-network providers and prefer the simplicity and lower costs associated with in-network-only care.

Point of Service Plans (POS)

Point of Service (POS) plans offer HMO and PPO features. Like HMOs, members typically need to designate a primary care physician and get referrals to see specialists. However, like PPOs, POS plans offer the flexibility to go out-of-network at a higher cost. This plan is ideal for Colorado small businesses looking for a balance between cost savings and flexibility, allowing employees to make more personalized healthcare decisions with guidance from their PCP.

Self-funded Health Plans

Technically speaking, self-insured employers pay for claims out of pocket when they arise instead of paying a predetermined premium to a carrier for a small group plan.

This type of plan, also known as a self-insured plan, is usually seen with a large enterprise as a means to control their healthcare spend and manage their risk pool.

The benefits of this type of plan are that it's more customizable to your workforce, you have control over the health plan reserves so you can maximize your interest income, it’s more affordable per enrolled employee than a traditional plan, there's no pre-funding of health coverage, and you aren't subject to state health insurance premium taxes (usually around 2 to 3%).

They’re also subject to fewer regulations and allow employers to customize their healthcare plan to meet their unique business needs.

And because companies are paying only for the healthcare costs of their own employees, there may be money left over at the end of the year that can go toward other business needs.

Self-funded plans, while ideal for some types of companies, really aren't fit for small companies.

While self-funded plans allow the company to potentially save the profit margin that an insurance carrier adds to its premium, the potential risk is much higher since the company is responsible for paying out the actual claims—especially in the event of catastrophic claims that could potentially bankrupt a company.

Risk is inherent to any small business, but adding risk from a self-funded plan is not the type of risk you want to take.

Health Sharing Plans

Health-sharing plans are a cooperative approach to managing healthcare expenses that can be an alternative to traditional health insurance. These plans involve a community of individuals who share similar ethical or religious beliefs and agree to help each other cover their medical expenses. While not insurance in the traditional sense, health-sharing plans often function similarly by collecting monthly shares that are then allocated to members' eligible medical expenses. These plans can be particularly appealing for small businesses in Colorado that might find traditional small-group health insurance too costly or those seeking a more community-oriented approach to healthcare.

HSAs (Health Savings Accounts)

Health Savings Accounts (HSAs) are tax-advantaged savings accounts designed to help individuals with high-deductible health plans (HDHPs) manage their out-of-pocket medical expenses. Contributions to an HSA are tax-deductible, the earnings grow tax-free, and withdrawals for qualified medical expenses are tax-exempt. For small businesses in Colorado, offering HSAs can be a way to provide valuable health benefits to employees, encouraging them to save for future healthcare needs while reducing their taxable income. HSAs are especially beneficial in conjunction with HDHPs, providing a financial cushion for healthcare expenses.

Direct Primary Care

Direct Primary Care (DPC) is an innovative healthcare model that simplifies primary care delivery. Unlike traditional health plans, DPC involves a flat monthly fee that patients pay directly to the healthcare provider, covering all or most primary care services, including consultations, visits, and routine examinations. This model eliminates the need for insurance billing and often provides patients with more personalized and accessible care. Incorporating DPC into their healthcare options for Colorado small businesses can lead to more predictable healthcare costs and improved employee satisfaction with their healthcare services.

Case Study: An ICHRA Success Story, Snarf's Sandwiches

Snarf's Sandwiches, a popular sandwich shop in Colorado, was seeking an effective way to provide health benefits to its employees. They were faced with the challenge of managing a diverse workforce with various health needs and financial capacities.

The management decided to adopt the ICHRA approach, and that's where Take Command stepped in. With the ICHRA model, Snarf's Sandwiches could contribute a fixed amount each month towards their employees' health insurance costs. This setup allowed employees to pick a plan that best suited their individual needs.

Implementing ICHRA with Take Command Health provided several key benefits to Snarf's Sandwiches:

- Flexibility: The ICHRA model allowed Snarf's Sandwiches to set the contribution amounts that worked best for the business, while employees were able to choose the health plan that fit their unique needs.

- Savings: Adopting ICHRA resulted in considerable savings for Snarf's Sandwiches. The model helped control health benefit costs and also offered tax benefits.

- Compliance and Ease: Take Command handled all aspects of ICHRA administration, from setting up the arrangement to managing reimbursements and ensuring compliance with relevant regulations.

- Employee Satisfaction: Employees expressed high levels of satisfaction, as they could choose the plan they preferred and get reimbursed for it.

This experience highlights how Take Command’s ICHRA administration can help Colorado businesses like Snarf's Sandwiches provide meaningful, flexible, and cost-effective health benefits to their employees.

Read the full story here →

Showcasing Colorado health insurance companies that integrate with ICHRA

The state of Colorado offers a vibrant lineup of eight carriers that provide individual health insurance plans, aligning perfectly with ICHRA usage. Based on the popularity among our clients' employees, here are the health carrier options available in Colorado:

Bright Health Plan: Known for their personalized approach to healthcare, Bright Health Plan provides access to affordable, quality care, and an easy-to-navigate health experience.

Oscar: With a tech-driven approach to healthcare, Oscar offers simple and personal health insurance plans designed with the user's experience in mind.

Cigna: A leading global health service company, Cigna has a vast network of healthcare providers and offers a range of plans to suit different healthcare needs.

Anthem: Anthem is renowned for its wide range of health plan options and extensive provider network, offering coverage tailored to individual needs.

Kaiser Permanente: A recognized leader in healthcare, Kaiser Permanente operates as both a health insurance provider and a healthcare provider, delivering coordinated care to its members.

Rocky Mountain Health Plans: As a part of UnitedHealthcare, Rocky Mountain Health Plans provides access to an extensive network and a variety of plan options.

Denver Health: With a comprehensive network of top doctors and a variety of plan options, Denver Health aims to deliver excellent care to its members.

Streamline your benefits management. Switch to a hassle-free HRA plan!

These carriers have demonstrated strong performance and popularity among Colorado residents utilizing ICHRA. As the health insurance landscape continues to evolve, we expect this lineup to continue providing quality options tailored to individual health needs.

Why HRAs Stand Out for Colorado Businesses

For Colorado businesses looking to provide health benefits to their employees, HRAs offer a compelling option that stands out from other health benefits choices. Let's delve into why HRAs have emerged as an increasingly popular choice for Colorado employers:

Flexibility and Customization

HRAs, like ICHRA and QSEHRA, provide flexibility. Unlike traditional group insurance plans, HRAs allow employers to set their budget. This can be particularly beneficial for small to medium-sized businesses that need to manage costs while still providing competitive health benefits.

Additionally, HRAs can be customized based on factors such as the employee's family size, age, and job role, allowing employers to tailor benefits to suit their team's unique needs.

Employee Choice

With an HRA, employees have the freedom to choose the individual health insurance plan that best meets their needs and preferences. This is a significant shift from the one-size-fits-all approach of traditional group health insurance, and can lead to higher employee satisfaction with their health benefits.

Cost Efficiency

HRAs can offer cost advantages to both employers and employees. Employers decide how much they want to contribute to the HRA, giving them control over their health benefits budget. For employees, HRA funds can be used to pay for insurance premiums and qualified health expenses, often leading to lower out-of-pocket costs.

Compatibility with Premium Tax Credits

Employees who are eligible for premium tax credits have the option to choose between applying these credits towards their health insurance premiums or receiving an HRA contribution from their employer. This gives employees more control over their health care spending and makes health insurance more affordable for those who qualify.

Simplicity and Ease of Use

Managing HRAs can be straightforward and efficient, especially with the help of HRA administration services. These platforms take care of the complexities of compliance, record keeping, and reimbursements, making HRAs an easy option for businesses of all sizes.

By offering flexibility, cost-efficiency, and a high degree of choice, HRAs present an appealing option for Colorado businesses looking to offer health benefits to their employees. With the robust individual health insurance market in Colorado, it's an ideal environment for businesses to take advantage of the unique benefits that HRAs provide.

Capitalizing on Colorado's Individual Health Insurance Plans with HRAs

As an employer in Colorado, understanding the synergistic relationship between HRAs and the various individual health insurance plans available in the state is key to creating a sustainable, effective health benefits strategy. By pairing an HRA with one of the prominent carriers in Colorado, you can offer your employees a customized, cost-effective health benefits solution that meets their unique needs and preferences. Let's delve into how different individual health insurance carriers in Colorado align with an HRA to provide a well-rounded, employee-centric health benefits plan.

Bright Health Plan

- Flexible plan options that cater to diverse employee health needs.

- When paired with an HRA, employers can control costs while still providing robust coverage.

- Employees can choose a plan that best suits their needs, enhancing their satisfaction with the health benefits.

Oscar

- Oscar plans are known for their user-friendly approach, and when paired with an HRA, this could result in higher employee engagement with their health care.

- Employers can help employees afford these comprehensive plans without bearing excessive costs.

Cigna

- Cigna provides a wide array of plans and a large provider network. An HRA can help make these plans affordable for employees.

- Employers can provide employees access to a top-tier insurer while keeping costs predictable.

Anthem

- Anthem offers diverse coverage options that cater to various health needs.

- With an HRA, employers can offer access to these broad options while maintaining control over their healthcare budget.

Kaiser Permanente

- Kaiser Permanente offers integrated care, promoting preventative health. An HRA can assist employees with costs, making these valuable plans more accessible.

- Employers can enhance the value of their health benefits by pairing Kaiser Permanente's comprehensive coverage with the cost-saving advantages of an HRA.

- Some employees love Kaiser Permanente, others would prefer other carriers. HRAs allow for employees to choose Kaiser Permanente if they want Kaiser Permanente. Problem solved.

Rocky Mountain Health Plans

- Rocky Mountain Health Plans provide a range of options suitable for Colorado's diverse workforce.

- When paired with an HRA, employees can choose the plan that best fits their unique needs, increasing their health benefits satisfaction and overall job satisfaction.

Denver Health

- Denver Health provides plans focusing on community-based care, promoting local health networks.

- With an HRA, employers can offer a localized, community-focused health benefits solution that simultaneously keeps business health benefit costs under control.

Overall, HRAs can work seamlessly with Colorado's individual health insurance market, offering employers a flexible, cost-controlling solution while providing employees the freedom to choose a plan that best suits their needs. The result is a win-win situation for both employers and employees, enhancing the overall effectiveness of the company's health benefits strategy.

Discovering the HRA Advantage for Colorado Businesses

With a competitive insurance market, a diverse range of available plans, and supportive legislation, Colorado presents an ideal landscape for HRAs to thrive. Let’s take a look at the options.

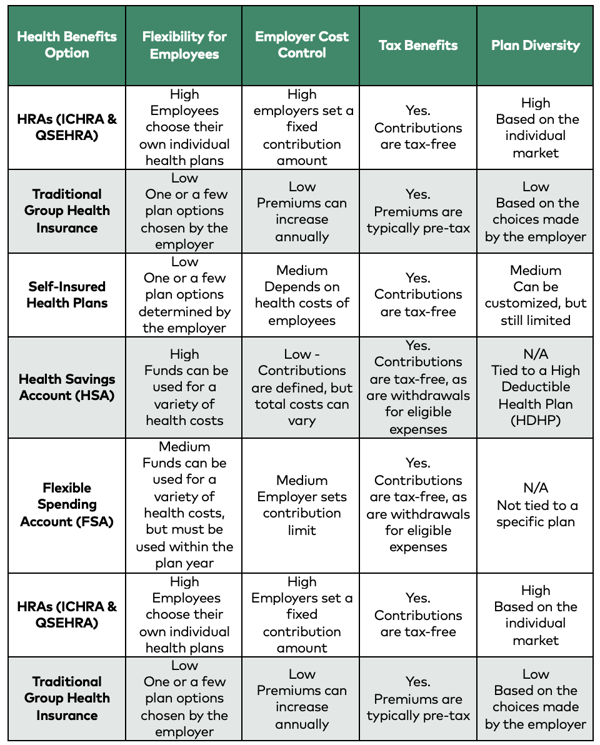

As shown, HRAs can provide the greatest flexibility for employees, the best cost control for employers, and offer tax advantages, positioning them as a preferable choice for many businesses.

Harnessing the Take Command Advantage for Colorado Small Business Health Insurance

When it comes to navigating the intricacies of HRAs and their effective implementation, Take Command stands out as a beacon in the health benefits world. With its roots deeply planted in simplifying health insurance for both businesses and individuals, we aim to help Colorado businesses decode the complexities of health benefits to make informed decisions.

As a leading HRA administration company, we are committed to helping you understand the differences between ICHRA and QSEHRA. Our experienced team is dedicated to assisting Colorado businesses, helping you find the right health benefits strategy that matches your unique needs and budget.

At Take Command, we not only help you comprehend the specifics of HRAs, but we also provide support in implementing them. We handle all the heavy lifting – managing reimbursement procedures, compliance paperwork, and employee education. Our seamless platform ensures your HRA administration is easy, efficient, and compliant with all relevant regulations.

We work in tandem with your team to provide educational resources and personalized support for your employees, ensuring they make the most out of their HRA. We ensure that your employees understand their benefits and feel empowered to take control of their healthcare decisions.

By partnering with Take Command, Colorado businesses can benefit from an ally committed to simplifying health benefits while providing the best possible health insurance solutions. We're here to guide you every step of the way, offering the advantage of expertise, convenience, and peace of mind when it comes to managing your business's health benefits.

The Road Ahead: Embracing Colorado's Health Benefits Landscape

Alright, we've covered a lot of ground, haven't we? Let's quickly recap the journey.

We started off looking at Health Reimbursement Arrangements, or HRAs. These nifty tools (like ICHRAs and QSEHRAs) are shaping up to be real game-changers for businesses in Colorado. They're flexible, they're cost-effective, and they give your employees the freedom to pick a plan that works for them. Pretty cool, right?

Next, we dove into the vast world of health benefits in Colorado, exploring how HRAs gel perfectly with our individual health insurance market. We also unpacked how recent laws and regulations are influencing the health benefits scene in Colorado.

To bring it all to life, we shared a case study of how one company nailed it with an ICHRA and our team here at Take Command.

That's where we come in. As a leading HRA administration company, we're here to guide your business every step of the way. If you're a Colorado business and you want to take your health benefits to the next level, it's time to think HRAs. And we're here to help you make it happen.

So, what do you say? Ready to shake things up with HRAs? Let's take command of the future of health benefits together!

FAQs For Colorado Small Business Health Insurance

How much does small business health insurance cost in Colorado?

The cost of small business health insurance in Colorado can vary widely depending on several factors, including the size of the business, the types of plans chosen, the coverage levels, and the demographics of the employees (such as age and health status). Generally, the premiums are shared between the employer and the employees, and choosing plans with higher deductibles can lower the monthly premiums. To get a more accurate estimate tailored to specific circumstances, businesses should request quotes from multiple insurance providers or consult a broker specializing in small-group health insurance in Colorado.

What administrative requirements do I have as a Colorado employer to offer an HRA?

As a Colorado employer offering a Health Reimbursement Arrangement (HRA), you must comply with several administrative requirements:

- Plan Documents: You need to provide all participating employees with a written plan document that outlines the HRA’s terms and conditions, including the reimbursement process, eligible expenses, and annual contribution limits.

- Privacy Compliance: Ensure compliance with privacy laws such as HIPAA, which involves protecting the confidentiality of employee health information.

- Non-Discrimination Tests: HRAs must comply with IRS non-discrimination rules, meaning the plan must benefit all employees equally and not favor highly compensated employees.

- Record Keeping: Maintain accurate records of all reimbursements and expenditures for IRS purposes and efficiently manage claims.

What expenses are not eligible for HRA Reimbursement?

In an HRA, not all health-related expenses are eligible for reimbursement. Generally, the IRS dictates that reimbursable expenses must be primarily to prevent or alleviate a physical or mental defect or illness. Some common examples of non-eligible expenses include:

- Premiums for life insurance or income protection policies

- Expenses that have been reimbursed elsewhere or are eligible for reimbursement through another plan

- Non-prescription drugs (over-the-counter medications), unless prescribed by a doctor

- Cosmetic procedures that are not medically necessary

These guidelines ensure that the HRA is used as intended—to support employees with their health care needs while maintaining compliance with tax laws and regulations.

Can I offer different health insurance plans to different employees?

Yes, Colorado employers can offer different health insurance plans to various groups of employees. Still, it's essential to ensure that any distinctions are based on legitimate business classifications, such as job function, department, or geographic location, and comply with non-discrimination laws. Structuring benefits in this way can help tailor the health coverage to the specific needs of various groups within the company.

How do I handle health insurance for remote employees living out of state?

For remote employees residing out of state, employers should consider plans that provide a broader network or multi-state coverage to ensure accessibility. Alternatively, reimbursing employees for individually purchased health insurance through an HRA can be an effective solution. This approach offers flexibility and ensures remote employees have coverage that meets their local healthcare needs.

What are the penalties for not offering health insurance in Colorado?

Under the Affordable Care Act (ACA), businesses with 50 or more full-time equivalent employees must offer health insurance or face penalties. These penalties apply if at least one employee receives a premium tax credit for purchasing coverage through the ACA marketplace. This requirement underscores the importance of providing suitable group health insurance or exploring alternatives like HRAs to avoid fines.

Let's talk through your HRA questions

Fill out the form below to connect with our team and see if an HRA is a good fit.

Susanne is a copywriter specializing in the health and wellness industry. Before starting her own business, she spent nearly a decade at a marketing agency doing all of the things – advisor, copywriter, SEO strategist, social media specialist, and project manager. That experience gives her a unique understanding of how the consumer-focused content she writes flows into each marketing piece. Susanne lives in Oklahoma City with her husband and two daughters. She loves being outdoors, exercising and reading.