Wondering what the reporting requirements are for ICHRA? Based on the latest instructions from the IRS, this post walks you through the ICHRA requirements for ALEs and small employers, as well as reporting on 1095-Cs.

ICHRA Reporting

Here's what to keep in mind during tax time and beyond as you tackle ICHRA reporting.

ICHRA Requirements for ALEs

Applicable Large Employers (ALE’s) with 50 or more full time equivalent employees will be required to file Form 1094-C and accompanying Forms 1095-C with the IRS. In addition, the employer is required to provide Form 1095-C to any employee who is full-time for at least one month during the calendar year.

Recognized as a type of group plan, employers have to file the benefit with the IRS at tax time. Filings differ based on employer size.

Requirements for Small business employers

Employers with less than 50 full-time equivalent employees, current regulations require you to file Form 1094-B and accompanying Forms 1095-B with the IRS and provide Form 1095-B to any employee who is full-time for at least one month during the calendar year.

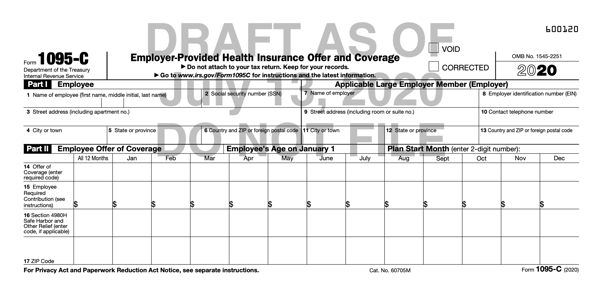

What you need for ICHRA reporting on 1095-C

In order to complete the 1095-C form for ICHRA, the employer will need to gather the following information:

- employee zip code of residence

- who was offered ICHRA? (employee only, employee + spouse, employee + dependents)

- Safe Harbor Used to calculate Affordability: employee residence zip code or employer zip code

- Is the ICHRA offering Affordable?

- Non full-time employees offered ICHRA

- Employee required contribution amount for excess premium

ICHRA reporting line by line for 1095-C

The information gathered will be used in the following Lines:

Line 14 - updated codes added for ICHRA

1L. Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability determined by using employee’s primary residence location ZIP Code.

1M. Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee’s primary residence location ZIP Code.

1N. Individual coverage HRA offered to you, spouse and dependent(s) with affordability determined by using employee’s primary residence location ZIP Code.

1O. Individual coverage HRA offered to you only using the employee’s primary employment site ZIP Code affordability safe harbor.

1P. Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site ZIP Code affordability safe harbor.

1Q. Individual coverage HRA offered to you, spouse and dependent(s) using the employee’s primary employment site ZIP Code affordability safe harbor.

1R. Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents.

1S. Individual coverage HRA offered to an individual who was not a full-time employee.

Line 15 - Employee required contribution for ICHRA is the excess of the monthly premium based on the employees applicable age for the applicable LCSP over the monthly ICHRA amount (annual ICHRA amount divided by 12)

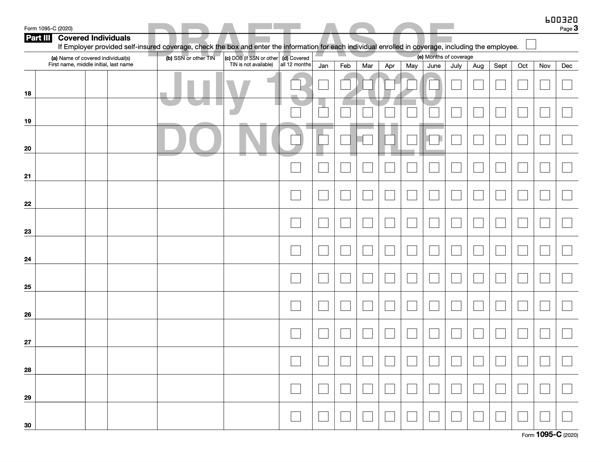

Line 17 - applicable zip code employer used to determine affordability for ICHRA

Another change is the inclusion of Line 17 to provide monthly zip code information for those employees who were offered coverage through an individual coverage HRA.

Depending on whether affordability of that coverage was determined based on the employee’s primary residence versus primary work location, the zip code corresponding to the employee’s primary residence or primary work location applies.

Let's talk through your HRA questions

I wrote this blog because I love helping people decode confusing insurance jargon and understand the fine print. I'm a licensed health insurance professional and specialize in simplifying health insurance for individuals and small businesses. My QSEHRA articles have been featured regularly on Accounting Today, Accounting Web, HRWeb, and other industry publications. I'm also a member of Take Command Health's client success team and a full-time mom. Learn more about me and connect with me on our about us page. Thanks!