A friendly reminder: Please note that we are not licensed tax professionals. Our mission is to empower small business owners and entrepreneurs to make smart decisions when it comes to health insurance.

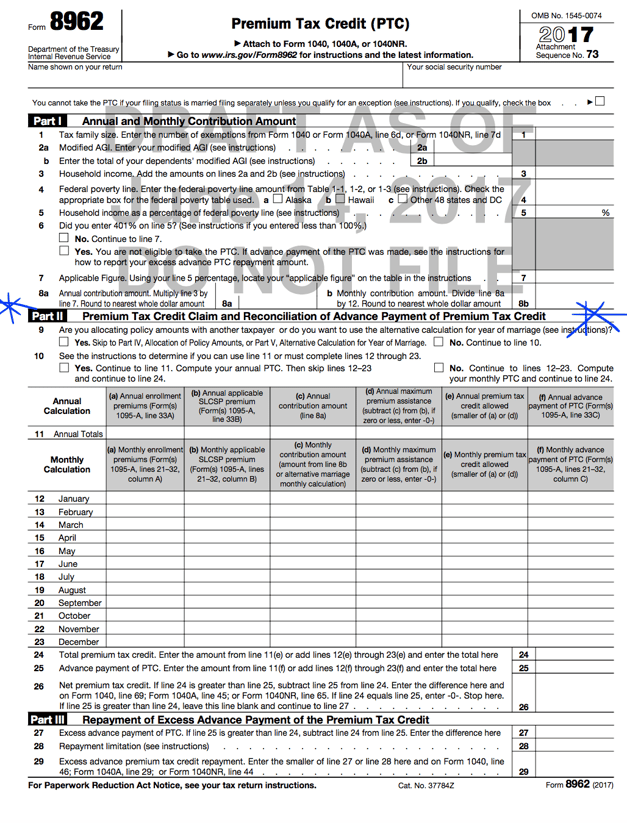

This past week, the IRS released a draft of Form 8962 which outlines—for the first time ever—instructions for QSEHRAs, calculating Premium Tax Credit (PTC) and reconciling it with Advance Payment of Premium Tax Credits (APTCs). This matters for small business owners and startups that are using a QSEHRA (small business HRA) to contribute pre-tax dollars to cover healthcare expenses for their employees. It's also an exciting step as QSEHRAs are gaining traction in the marketplace (and for good reason!). As always, communicating these updates to your employees is a crucial step to ensuring that your team makes the most out of their small business HRA arrangement. Here's what to know about small business HRAs and taxes.

Learning the lingo: PTCs and APTCs

The premium tax credit is a subsidy which is available to those purchasing health insurance from the health insurance marketplace (exchange). The credit provides financial assistance to pay the premiums for the qualified health plan offered through a Marketplace by reducing the amount of tax owed, issuing a refund, or increasing refund amount.

Advance payment of the premium tax credit (APTC) is a payment during the year to your insurance provider that pays for part or all of the premiums for a qualified health plan covering you or an individual in your tax family. APTC eligibility is based on the Marketplace’s estimate of the premium tax credit an employee will be able to take on your tax return.

Decoding Form 8962

New this year on Form 8962 is the addition of qualified small employer health reimbursement arrangement (QSEHRA). New rules enacted under the 21st Century Cures Act of 2016 allow eligible employers with fewer than 50 employees to provide a small business HRA to their employees. Under such an arrangement, an employer can reimburse employees for medical expenses and premiums for Marketplace health insurance. HRA contributions made by an employer can reduce or eliminate any premium tax credits employees are eligible for. That's why we don't typically recommend QSEHRA if employees are eligible for large tax credits. Our team can model the outcomes for you so you can make the best decision for your business.

If your employees purchased health insurance through the Marketplace, Form 8962 is necessary to complete their taxes and determine if they owe tax or if the government owes them a refund.

Tax time checklist for employees

Here's a quick checklist to share with your employees who benefit from small business HRA contributions at your business so they can prepare their taxes correctly.

- Form 1095-A (Health Insurance Marketplace Statement) will be provided to you from the Marketplace if you enrolled in health insurance coverage for 2017 through the Marketplace. Form 1095-A shows the months of coverage purchased through the Marketplace and any APTC paid to your insurance company to help cover your monthly premium.

- Form 8962 If APTC was paid on your behalf or, if APTC was not paid on your behalf but you wish to take the PTC, you must file Form 8962 and attach it to your tax return (Form 1040, 1040A, or 1040NR). At enrollment, the Marketplace may have referred to APTC as your “subsidy” or “tax credit” or “advance payment.”

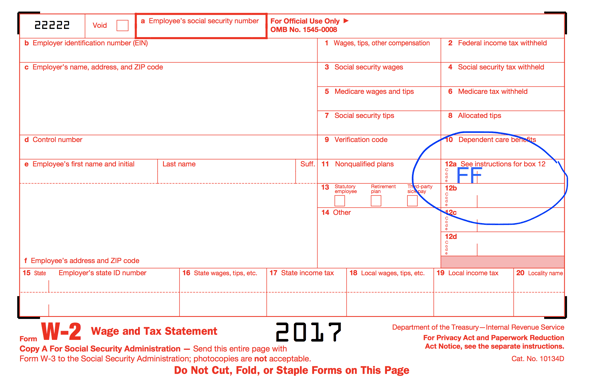

- W-2 If you were covered under a small business HRA, your employer should have reported the annual permitted benefit in box 12 of your Form W-2 with code FF.

- Calculate your Premium Tax Credit by following the instructions in IRS publication 8962.

Take Command Health is here to help

Keeping up with the requirements and policies surrounding small business HRAs can be time-consuming and confusing, especially when you are busy running your own business. Did you know our new small business platform will handle all the accounting and legal legwork for the QSEHRA, take care of onboarding each of your employees, and make tax time easy and painless? You'll never have to hassle with receipts or worry about setting up a health plan again.

Another great resource to dive into is the reimbursement rules chapter in our handy new QSEHRA Guide.

Let's talk through your HRA questions

I wrote this blog because I love helping people decode confusing insurance jargon and understand the fine print. I'm a licensed health insurance professional and specialize in simplifying health insurance for individuals and small businesses. My QSEHRA articles have been featured regularly on Accounting Today, Accounting Web, HRWeb, and other industry publications. I'm also a member of Take Command Health's client success team and a full-time mom. Learn more about me and connect with me on our about us page. Thanks!