At Take Command Health, one of our core values is continuous learning to spur improvement for our processes and products, and our user experience. For that reason, we surveyed our clients recently to learn more about the innovative companies opting to reimburse for health insurance.

We had a great response when we polled our clients (thank you, awesome clients!), which included both companies that are offering Individual Coverage HRAs (ICHRAs) and companies offering Qualified Small Employer HRAs (QSEHRAs).

Here's what we learned from our HRA clients.

HRA benefits: The top reasons why companies opt for an HRA

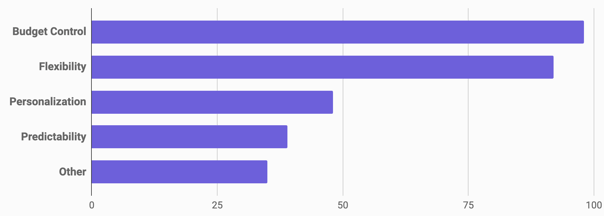

There are many HRA benefits that attract business owners, brokers, and benefits consultants. Our clients reported that the top reasons included budget control, flexibility, personalization, and predictability.

We think HRAs are pretty great, and we were thrilled to see that our clients felt the same—citing budget control and flexibility as top selling points.

What other selling points did clients like? The tax benefits, not worrying about group participation requirements, avoiding expensive renewals, easy to set up, easy to administer without a HR department, benefit can be extended to staff on spouse’s insurance (QSEHRA only), making HRAs a good choice for them.

Here's how the benefits of HRAs stacked up.

Remember, here's how HRAs like QSEHRA and ICHRA benefit employers and their workers.

- Budget control: Set a monthly budget and stick to it. Keep the leftover funds and enjoy the tax benefits.

- Personalized benefits: Many employers have a diverse workforce, meaning that finding one plan for everyone to approve of is extremely difficult. With an HRA employees can choose the best plan for them—one that works with their doctors, their needs, their prescriptions—and one they can take with them when they leave.

- Flexibility: Employers can design their HRA around diverse workforce, scaling rates by family size and age, and in some cases, different classes of employees to cater to remote workers, part-timers, and hourly vs. salary.

- Predictability: Instead of facing expensive renewals year over year like a group plan, and having to manage the risk that comes with it, HRAs satisfy employer mandate (ICHRA), provides quality, ACA Minimum Essential Coverage for employees, and are very predictable from a budgeting perspective.

HRAs attract all kinds of companies

As we reported in our 2020 ICHRA report and 2019 QSEHRA report, many industries have been attracted to this reimbursement model of insurance. Top industries to adopt both of these HRA models include professional services, non-profit, healthcare, and tech.

As well, company ownership varies widely with our HRA clients. We were excited to see women-owned businesses, minority-owned businesses, and veteran-owned businesses represented well.

Of those who responded, one in five of our clients using an HRA are women-owned businesses; one in 10 are veteran owned.

Here are a few highlights:

- Women owned businesses: 19.7%

- Minority owned businesses: 7.8%

- Veteran owned businesses: 9.6%

HRAs offer a group plan alternative

It's easy to see why many would make the switch (compare and contrast group plans with ICHRAs or HRA benefits over traditional plans here). A few reasons that HRAs like QSEHRA and ICHRA win over group plans include:

- Transfers employer responsibility for health risks.

- More personalized plan choices for employees- good bye "one size fits all" group plans.

- Simpler and more flexible plan design options.

- Greater budget control.

- No participation concerns.

11% of our clients moved from a group plan to an HRA.

Of those, the vast majority reported that they like their HRA better than their group plan.

Conversely, 89% were offering benefits for the first time—a statistic that is extremely exciting. HRAs continue to be a great option for growing companies or startups that are beginning to offer health benefits.

HRAs have helped companies during COVID-19 pandemic

This year has certainly thrown a curve ball for employers and employees everywhere. The flexibility inherent to HRA design has helped many make adjustments to their benefits as they weather the economic fallout of the COVID-19 pandemic.

When we polled our clients, 38% of them said their HRA has been helpful during the pandemic.

In fact, 25% of them have made changes to their HRA to help combat the effects of the pandemic.

With group plans, there just aren’t many levers to pull—you either cancel your plan or you don’t; your employees are either part of the group plan or they are not.

Under normal circumstances, the familiarity of traditional group health plans makes them a popular choice as a small business health insurance option. But in uncertain times like what we're living through today, the predictability, portability, and flexibility of “defined contribution” health insurance models should be closely considered by employers now and in the future.

HRAs are easy as 1-2-3

We make HRA administration easy for admins at our companies. It's one of our biggest selling points, so we were excited to see that our clients think administering their HRA is easy too!

84% of our clients spend less than an hour per month administering their HRA.

According to our survey, 2% of our clients said they spent 3-5 hours per month administering their HRA, 13% reported 1-3 hours, and no one (yes! no one!) said it took more than six hours a month. This is huge!

Our platform makes it easy for admins, minimizing headaches, paperwork and man hours.

Here's a few of the things Take Command Health does for our clients as part of our HRA administration service.

- Compliance, notifications, monthly reporting, year-end W-2 reporting

- Legal plan documents

- Plan verification for employees

- HIPAA and Privacy Compliance

- Employee support through onboarding and plan enrollment

- and more!

HRAs can scale as your business grows

As we mentioned above, one of the many benefits of HRAs is the flexibility built in to the design. Unlike group plans, changes can be made as the need arises. In other words, your HRA can grow with your company and your budget. 29% of our clients have increased their allowances since they got started. That upward trend is helping employees all over the country and we couldn't be happier about it!

On a similar note, many of our clients switched from a QSEHRA to an ICHRA to offer their employees a greater monthly allowance.

Additional resources

- ICHRA FAQs

- ICHRA Affordability Calculator

- HRA Tax Savings Calculator

- ICHRA Guide

- QSEHRA Guide

- Small Business Health Insurance Guide

Don't hesitate to give us a shout! We would love to hear from you and chat about our favorite topic: HRAs!

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!