Small Business Health Insurance Tax Strategy

How can I get a tax deduction for my health insurance?

If you’re a small business owner or sole proprietor, you’ve probably wrestled with how to deduct your health insurance premiums and medical expenses from your taxes. Do you purchase through your business and try to “expense it”? What about a self-employed deduction? And if you have employees—how can I reimburse them without triggering tax consequences?

This guide is designed to help small business owners and sole proprietors discover and implement the most tax-efficient strategy for health insurance and medical expenses.

Small business tax deductions and health insurance

In this guide, we suggest the most tax-efficient strategies for small employers to pursue when purchasing health insurance so that they can maximize their tax deductions. A quick disclaimer—we’re licensed health insurance professionals and small business insurance experts, not tax professionals. Although we share our experience and advice and do our best to cite authoritative sources, you should always seek professional tax advice and not construe anything in this guide as specific tax advice because every situation is different. Ok? Good.

Let’s jump right to it—your best tax strategy will depend on three things:

- Your business entity type

- Whether you work alone or have (or plan to have) W-2 employees

- Whether you’re an owner or an employee

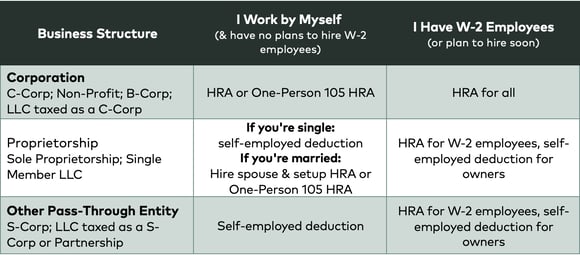

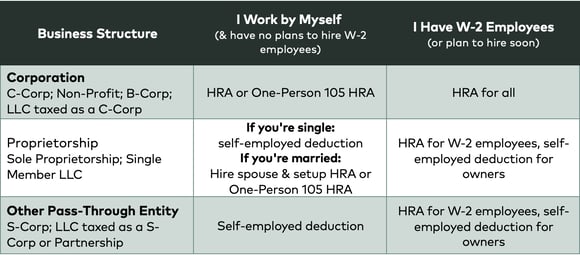

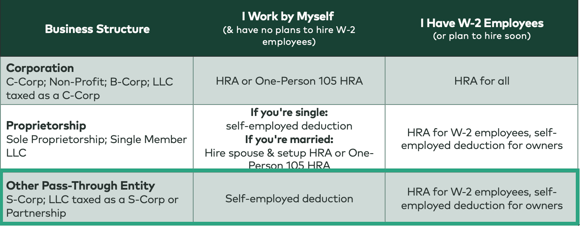

Based on the above, here is a quick table to summarize our recommendations (download a PDF version). The rest of this guide will explain these strategies in more detail. Please be sure to consult with a tax professional before implementing any of these strategies yourself:

Figure 1: Small Business HRA tax strategy overview by business entity type. Download a PDF version of this chart. Not to be used for tax advice. Please consult with a tax professional before implementing any strategy.

This is a bit of a “choose your own adventure” guide, so if you want to skip to the section that applies most directly to you, please feel free to do so. Here’s what we’ll cover:

- Overview of HRAs

- Deep-Dive: One-Person 105 HRAs

- Deep-Dive: Small Business HRAs (QSEHRAs)

- Strategies for a Corporation

- Strategies for a Sole Proprietor

- Strategies for Partnerships & S-Corps

- Next Steps and How to Get Started

Should I reimburse or try to get a group health plan?

What is a Section 105 plan?

A Section 105 plan, often called a 105 HRA, is a health reimbursement arrangement that provides businesses with a tax-advantaged way to reimburse employees for medical expenses. This type of plan is named after Section 105 of the Internal Revenue Code, which establishes the guidelines for employers to make contributions to employee health costs that are tax-deductible to the business and tax-free to the employees.

Under a Section 105 plan, employers can reimburse their staff for qualified health expenses, including co-pays, deductibles, prescriptions, and insurance premiums. These reimbursements are not taxable income for employees, making them a highly sought-after benefit.

Understanding that health insurance can be a business expense is vital for small businesses. Not only is an HRA tax deductible for the business, but it also provides a valuable tool for controlling the cost of health benefits. Small business owners can use a 105 HRA to offer a benefits package that can help attract and retain top talent without the financial burden associated with traditional health insurance plans.

Moreover, Section 105 plans offer flexibility. Employers can design their HRA to fit their company's and employees' specific needs, including setting caps on reimbursements or defining specific categories of expenses that are eligible for reimbursement.

In conclusion, a Section 105 plan is a powerful solution for small businesses looking to manage their health insurance costs effectively. It aligns with the need to make health insurance tax deductible for small business owners, functioning as a strategic business expense that serves the dual purpose of financial management and employee satisfaction.

Benefits of Section 105 Plans

Section 105 plans, also known as Health Reimbursement Arrangements (HRAs), offer several benefits that make them an appealing choice for small business owners. These plans provide financial perks and allow for adaptable health benefit solutions tailored to the business and its employees.

Budget Friendly

One of the most significant advantages of Section 105 plans is their budget-friendly nature. Employers can set fixed allowances for their employees' healthcare costs, which can help stabilize and predict the company's healthcare budget. With this structure, small businesses can provide meaningful benefits to their employees without the unpredictability of rising insurance premiums, making HRAs a financially sustainable option.

Tax Advantages

Section 105 plans come with notable tax benefits. Contributions made by employers are tax-deductible, and reimbursements received by employees are excluded from their gross income, hence not subject to federal income tax. This aspect of HRAs can lead to considerable tax savings for both parties, reinforcing that health insurance is tax deductible for small businesses and that the HRA can serve as a valuable business expense.

Flexibility

Flexibility is a cornerstone of Section 105 plans. Employers can tailor their HRA to match the specific needs of their workforce, deciding on the types of medical expenses that can be reimbursed and setting limits that align with their budgetary constraints. This flexibility also extends to employees who can choose how to spend their healthcare dollars, making HRAs a customizable benefit that can adapt to the diverse needs of a dynamic workforce.

By implementing a Section 105 plan, small businesses can offer a competitive benefits package that is financially and operationally advantageous. This will enhance their ability to attract and retain the best talent while managing costs effectively.

Types of Section 105 Plans

Section 105 of the Internal Revenue Code authorizes several types of plans that allow employers to reimburse employees for medical expenses on a tax-advantaged basis. Each type caters to different business needs and sizes, offering a range of flexibility and control.

HRAs (Health Reimbursement Arrangements)

HRAs are employer-funded health benefit plans that reimburse employees for incurred medical expenses, including individual health insurance premiums. They are highly adaptable, allowing employers to set reimbursement limits and define eligible expenses. HRAs are particularly beneficial for small businesses due to their cost control and tax advantages, making them a popular choice under Section 105 plans.

MERPs (Medical Expense Reimbursement Plans)

Like HRAs, MERPs allow employers to reimburse employees for out-of-pocket medical costs. The primary distinction is that MERPs can be designed to complement existing group health plans by covering expenses not paid by insurance, such as deductibles and co-insurance. This makes them a valuable addition to an employer's health benefits portfolio, enhancing the overall comprehensiveness of healthcare coverage provided to employees.

FSAs (Flexible Spending Accounts)

FSAs are a type of Section 105 plan that allows employees to contribute pre-tax dollars to an account for medical expenses. Employers may also contribute to FSAs, but unlike HRAs and MERPs, FSAs are typically funded through employee salary reductions. FSAs offer the benefit of reducing an employee's taxable income. Still, they often come with the "use it or lose it" rule, meaning employees must use the funds within the plan year or risk forfeiting the remaining balance.

Each of these Section 105 plans offers unique benefits and can be leveraged depending on the specific needs and goals of the small business. Whether it's the comprehensive coverage of an HRA, the supplemental nature of a MERP, or the employee-funded convenience of an FSA, Section 105 plans are versatile tools in structuring effective health benefits.

Section 105 HRAs vs Group Health Plans

We have many clients who initially contacted us asking how they can get a group health plan for their family or a 5-person small business. It used to be that binding a few folks together to “get on the group plan” was the only way to purchase insurance.

Which HRA is right for you?

Small Business Health Insurance Tax Strategy

How can I get a tax deduction for my health insurance?

If you’re a small business owner or sole proprietor, you’ve probably wrestled with how to deduct your health insurance premiums and medical expenses from your taxes. Do you purchase through your business and try to “expense it”? What about a self-employed deduction? And if you have employees—how can I reimburse them without triggering tax consequences?

This guide is designed to help small business owners and sole proprietors discover and implement the most tax-efficient strategy for health insurance and medical expenses.

Small business tax deductions and health insurance

In this guide, we suggest the most tax-efficient strategies for small employers to pursue when purchasing health insurance so that they can maximize their tax deductions. A quick disclaimer—we’re licensed health insurance professionals and small business insurance experts, not tax professionals. Although we share our experience and advice and do our best to cite authoritative sources, you should always seek professional tax advice and not construe anything in this guide as specific tax advice because every situation is different. Ok? Good.

Let’s jump right to it—your best tax strategy will depend on three things:

- Your business entity type

- Whether you work alone or have (or plan to have) W-2 employees

- Whether you’re an owner or an employee

Based on the above, here is a quick table to summarize our recommendations (download a PDF version). The rest of this guide will explain these strategies in more detail. Please be sure to consult with a tax professional before implementing any of these strategies yourself:

Figure 1: Small Business HRA tax strategy overview by business entity type. Download a PDF version of this chart. Not to be used for tax advice. Please consult with a tax professional before implementing any strategy.

This is a bit of a “choose your own adventure” guide, so if you want to skip to the section that applies most directly to you, please feel free to do so. Here’s what we’ll cover:

- Overview of HRAs

- Deep-Dive: One-Person 105 HRAs

- Deep-Dive: Small Business HRAs (QSEHRAs)

- Strategies for a Corporation

- Strategies for a Sole Proprietor

- Strategies for Partnerships & S-Corps

- Next Steps and How to Get Started

Should I reimburse or try to get a group health plan?

Section 105 HRAs vs Group Health Plans

We have many clients who initially contacted us asking how they can get a group health plan for their family or a 5-person small business. It used to be that binding a few folks together to “get on the group plan” was the only way to purchase insurance.

Types of HRAs

What does HRA stand for?

HRA stands for “Health Reimbursement Arrangement”. They are not overly complicated or scary but are built on a series of regulations to make sure they are being offered fairly and are achieving their intended aim of helping employees pay for benefits tax-free. The regulations also try to prevent the reimbursements from being used for things like executive compensation, fraud, discrimination, money laundering, etc.

HRA IRS Regulations

The regulations that have historically (and still) govern traditional HRAs come from Tax Code Section 105. Because of this you’ll hear tax geeks and insurance brokers refer to “Section 105 HRAs”.

You’ll also hear people talk about Integrated HRAs and Standalone HRAs. Here’s the difference:

-

Integrated HRAs:

are “integrated” with a traditional group health insurance plan and used to help reimburse out-of-pocket medical expenses not paid for by the group health plan. Typical examples would be co-pays, co-insurance, deductible payments, etc. -

Standalone HRAs:

are not required to be tied to a group plan. They have a complicated history and can be even more complicated to implement based on tangled federal and state insurance regulations. A few common types that still linger around are:- Spousal HRA—For employees covered by a spouse’s group plan, a Spousal HRA could reimburse medical expenses but not premiums.

- Retiree HRA—For former employees of a firm, an employer could use a Retiree HRA to help pay for retired members’ insurance premiums and medical expenses.

- Medicare HRA—For employers with less than 19 employees, employers could elect to reimburse a portion of an employee’s Medicare supplement premiums.

- Spousal HRA—For employees covered by a spouse’s group plan, a Spousal HRA could reimburse medical expenses but not premiums.

We want you to know about these different types of HRAs in case you’re talking to an old-school insurance broker or searching around the internet and come across old articles that mention some of the above HRA types (and in this case, old means before 2017).

Qualified Small Employer HRA (aka Small Business HRA)

It’s also important to know that in 2017 we got a new HRA, a special type of standalone HRA for small employers called a QSEHRA. QSEHRA stands for “Qualified Small Employer Health Reimbursement Arrangement”. The major difference is that QSEHRA was created through federal law (The 21st Century Cures Act) and not just conjured out of regulations. This makes QSEHRA much easier to understand and implement nationwide. It’s also super flexible, as we’ll talk about later. For this reason, we believe QSEHRA supersedes the previously described Standalone HRAs in 99% of situations.

Wondering how you could design your HRA?

Because of its legal footing, we believe QSEHRA effectively replaces previous standalone HRA implementations for small business owners and sole proprietors.

HRAs we recommend for Small Businesses and Sole Proprietors

Since this guide is about helping small business owners and sole proprietors implement an efficient tax-strategy, rather than talk about all HRA combinations in depth, we’re going to focus on the two we believe are most powerful and most relevant for owners and proprietors today:

-

One-Person 105 HRAs:

These are traditional HRAs integrated with an individual or family health plan

-

QSEHRAs:

These are the new standalone HRAs that allow small employers to reimburse employees for individual insurance and medical expenses

These HRAs are the best pathway for small business owners and sole proprietors to count their health insurance and medical costs as business expenses at the top of the tax waterfall. We provide a high-level summary of these HRAs below and then talk about strategies to deploy them based on your business entity type.

Note: As of 2020, we are be able to recommend two new types of HRAs, the “Excepted Benefit HRA” and the “Individual Coverage HRA”.

What is a One-person 105 HRA?

A One-Person 105 HRA goes by several names out in the wild. You may also see it called a “Single Participant HRA”, a “Section 105 HRA”, or a “One-person HRA”. This is because it doesn’t really have a name. It’s just a thing born out of a weird (but tried and true) loop-hole in Section 105 of the Tax Code under the Self-Insured Medical Reimbursement Plan provisions. For simplicity going forward, we’ll refer to them as “One-Person 105 HRAs”.

Recall from our overview of HRAs above that Section 105 HRAs must be integrated with a group health insurance plan. Group health regulations and IRS rules also specify that the HRA must be offered fairly to all eligible employees. But what if you only have a group of 1? Aha!

The question that lingered for years was if your business has only one employee (even if that employee happens to be you the owner), could that employee purchase an individual health insurance plan and integrate it with an HRA to get the benefits described in Section 105?

Thankfully the answer is “yes”, as long as you can meet the non-discrimination restrictions (IRC Section 105(h)(3)). In most cases, the only way to meet those restrictions is just to have one eligible employee; hence why we are calling this a “One-Person 105 HRA”. Essentially, you’re operating a regular HRA for a group of one. If you were to ever hire another eligible employee, the HRA would fail under Section 105 because that employee does not have access to participate in your individual or family health plan.

You can keep a One-Person 105 HRA and hire other employees if they fall into a category that can safely be deemed “not eligible” for the HRA in the eyes of the IRS. This includes employees under the age of 25, part-time employees (less than 25 hours a week), seasonal employees (less than 7 months a year), or employees with fewer than 3 years of service. Make sure to talk this through with your accountant and attorney. See IRC Section 105(h)(3); Reg. Section 1.105-11(c)(2)(iii)(C).

The One-Person 105 HRA will work great if you’re an owner and you’re the only employee of your business. If your business is structured as a corporation, this is easy. If you’re a sole proprietor, this is tricky because owners are not employees in the eyes of the IRS. There’s a work-around we’ll talk about in the Proprietor Strategy section below where you can hire your spouse as an employee to make it work.

So, why have a One-Person 105 HRA? What are the benefits?

One-Person 105 HRA Benefits

- Turns a tax deduction on your personal taxes (Form 1040) into a business deduction (Schedule C), reducing business and self-employment taxes

- Makes what you spend on health insurance premiums and medical expenses (copays, coinsurance, dental, etc.) into a business expense, as opposed to the self-employed deduction, which only allows you to deduct premiums

- Has ability to create a Net Operating Loss (NOL) deduction (for future years), which is not possible with the self-employed deduction even if you lose money

- Creates a full deduction for long-term care insurance and prescribed Over-the-Counter (OTC) drugs

- Not subject to the annual reimbursement limits of the QSEHRA

If you’re the only employee of your business and you have very high medical expenses, you should consider reforming your business as a C-Corp. Yes, you’ll be subject to double-taxation, but all your medical costs can become business expenses, greatly reducing your tax liability. Make sure to talk to your accountant!

QSEHRA

What does QSEHRA stand for?

QSEHRA stands for “Qualified Small Employer Health Reimbursement Arrangement”. It is sometimes called a Small Business HRA. We like to call it just QSHERA (“Q-Sarah”). We love QSEHRA so much we created an entire online guide like this one to unpack its nuances and discuss design strategies and implementation. If QSEHRA is an effective strategy for you or your employees, then I recommend you skim through our practical QSEHRA guide for small employers.

How does QSEHRA work?

In summary, QSEHRA allows small employers with fewer than 50 full-time employees to reimburse employees tax-free for individual insurance premiums and medical expenses. This is awesome, because it allows every dollar you spend to help your employees with insurance and medical expenses to be categorized as a business expense. If you’re giving employees a health insurance stipend or “bonus” or adding to their salaries to help with insurance, you’re a nice boss but you’re being like Bob in our example above and triggering taxes that you can avoid for both your business (payroll taxes) and for your employees (income taxes) could be avoiding. Here’s a tax calculator you can use to see for yourself.

QSEHRA is based on a reimbursement model. You the employer set the amounts you want to allow for reimbursement, and employees make claims to get paid. Reimbursements are subject to annual limits that are tied to inflation. For 2020, the limits are $5,250 a year ($437.50/mo) for single employees and up to $10,600 a year ($883.33 a month) for employees with families. These limits are usually great for employees but can feel restrictive if you, the employer, are the only employee and you have high insurance or medical expenses you’d like to include as a business expense.

Like One-Person 105 HRAs, QSEHRA works great if you’re an employee of your company. This can be tricky if you’re a sole proprietor or pass-through entity. We’ll talk about some strategies for those types of entities in the following sections.

What are the benefits of QSEHRA?

- Turns everything you spend on employee health benefits (including your own if you’re also an employee of your business) into a business expense (Schedule C)

- Allows employers to control costs and set the maximum reimbursement limits allowable

- Gives employers a lot of flexibility to set reimbursement rates, choose eligibility, and select what they want to reimburse or not

- Gives employees ability to choose what they want as long as they meet the insurance requirements for Minimum Essential Coverage (MEC) and the guidelines that you create

- Provides an optimized approach to group benefits instead of a “one-size-fits-all” traditional group plan

Unlock tax advantages with an HRA. Find out more today.

Setting up and managing a QSEHRA does not have to cost a lot or add complication to your business. Check out our QSEHRA Administration service. Our fees are nominal compared to your potential tax savings.

What’s the best health insurance if I’m a corporation?

Corporations are the easiest entity type to handle when it comes to health insurance because owners can also be employees. If you’re just getting started, there are obviously other implications with corporations you should talk to your accountant or attorney about.

Health insurance for corporations

Corporations for this discussion include C-Corps, B-Corps, Non-Profits, and LLCs taxed as C-Corps—anything where the entity is separate from ownership. As a corporation, you should be able to get all your insurance premiums and medical expenses counted as a business expense (Schedule C).

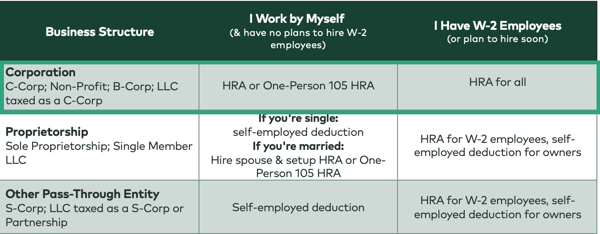

Here’s how we suggest Corporations approach health insurance (please consult your tax professional):

Figure 2: Suggested tax strategies for Corporations to maximize healthcare deductions. Download a PDF version of this chart. Not to be used as tax advice. Please consult with your licensed tax professional before implementing any strategy.

Your best strategy will hinge on whether you are the only employee and have no plans to hire in the future or if you have (or plan to soon hire new) W-2 employees. If you are the only employee of the corporation, you can choose between a One-Person 105 HRA or a QSEHRA. We’d recommend:

- If the QSEHRA’s reimbursement limits are enough for you, we recommend going with QSEHRA because it’s much cleaner regulatory-wise (see our HRA Overview section above) and you’re less likely to run into any reporting hurdles.

- If you have high insurance or medical expenses, then you need to go the One-Person 105 HRA route. This is because there are no statutory limits to how much you can expense through your business.

Depending on which strategy makes the most sense for you, please see our Next Steps section below and we can point you towards some resources to get started.

What’s the best health insurance if I’m a sole proprietor?

Health insurance for sole proprietors

Sole Proprietorships are awesome because, well, you’re doing your own thing! It can get a little tricky though because there’s no separation between you and your business in the eyes of the IRS (i.e., you’re a “pass-through entity” or “disregard entity”) and owners are generally not considered to be employees even if you’re working for your company full-time. This includes Sole Proprietorships and Single-Member LLCs that did not elect corporate taxation.

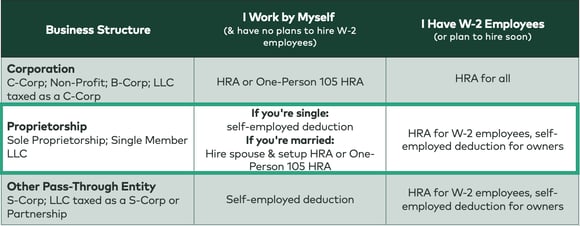

Here’s what we suggest for Sole Proprietors (please consult with your tax professional):

Figure 3: Suggested tax strategies for Sole Proprietors to maximize healthcare deductions. Download a PDF version of this chart. Not to be used as tax advice. Please consult with your licensed tax professional before implementing any strategy.

The best strategy for you depends on whether you have W-2 employees and your marital status (bet you didn’t expect that—we’ll explain). If you’re single and work by yourself, or if you have W-2 employees or plan to hire soon, your best course of action is going to be to take the self-employed deduction for yourself and set up a QSEHRA for your W-2 employees. That will get all your employees’ expenses into the business expense category. Unfortunately, you can’t get your personal insurance and medical expenses categorized that way, but we can still save some tax money by getting all your self-employed deductions. Skip to our Next Steps section to see how.

If you are a sole proprietor and work for yourself and have no plans to hire, and you are married, then we can explore a few more options. Recall from our HRA Overview section that HRAs only work for employees. Although as a proprietor you generally are not eligible for an HRA because you’re not an employee, your spouse can be an employee and eligible for an HRA and health plan that covers you.

Here’s the strategy if you’re a sole proprietor with no employees and you’re married:

- Hire your spouse as a W-2 employee:

- Your spouse’s salary can just be the amount you want to reimburse through the HRA, but it must be a fair wage for what they are doing (i.e., you can’t reimburse $100k through an HRA if your spouse is not actually doing that much work)

- It’s a good idea to have an employment contract and timesheet for record-keeping purposes

- Make your spouse the primary member on your family health plan

- Cover yourself as a dependent on your spouse’s health plan

- Set up a One-Person 105 HRA or QSEHRA for your spouse:

- Choose QSEHRA if you have health expenses that are less than the QSEHRA reimbursement limit ($10,250 as of 2018) or have other employees that are excludable under the QSEHRA regulations so that your spouse is the only eligible employee for the QSEHRA (see the Reimbursement Rules section of our QSEHRA Guide)

- Choose the One-Person 105 option if you have significant medical expenses or have other employees that are only excludable under the One-Person 105 rules (see Pro-Tip in the One-Person 105 HRA section above); the One-Person 105 HRA meets the HRA discrimination requirements because your spouse is the only eligible employee

- Save all your medical bills and records and have your company reimburse the bills each month from a separate account

This strategy only works if you don’t hire any other W-2 employees that would be eligible for either the QSEHRA or One-Person 105 HRA (make sure to look at those rules closely) and assumes that you and your spouse don’t own any other businesses that have employees (common ownership rules would likely apply and the plan would fail to meet Section 105 requirements). You’ll need to keep good records, too. This sounds like a loop-hole and it is, but it’s held up in tax court. The main case was Shellito v. Commissioner. If the above applies, see the Next Steps section for how to get started!

We’ve heard of anchor-spouses for immigration purposes, but we don’t recommend anchor-spouses solely for health insurance tax strategies. Make sure you love them first :)

Streamline your benefits management. Switch to a hassle-free HRA plan!

What’s the best health insurance if I’m a Partnership or S-Corporation?

Health insurance and partnerships, s-corps

If you’re not a corporation and you’re not a proprietor, you fall into this last category we collectively refer to as “Other Pass-Through Entities.” Like proprietors, these are entities where income from your business “passes through” and is reported on your personal tax form. Most of the time, you’re not able to classify yourself as an employee (even if you work for your business full-time) and instead are classified as an owner and required to pay self-employment taxes (talk to your accountant). These entities are typically S-Corps, Partnerships, and LLCs taxed as S-Corps or Partnerships. Note, when we talk about owners of S-Corps, we’re talking about owners with greater than 2% ownership.

Here’s how we suggest Partnerships, S-Corps, and LLCs taxed as such approach health insurance (please consult with your tax professional):

For Partnerships and S-Corps, there’s not a legal way (that we’re aware of) for owners to get their personal insurance and medical expenses counted as a business expense. If you read the Sole Proprietors Strategy section, you might ask, “wait, why can’t I hire my spouse and do what proprietors can do with the One-Person 105 HRA thing?” The problem for S-Corps are that spouses are attributed ownership of the S-Corp. The problem with Partnerships are that there’s more than one person (hence “partnership”) and the One-Person 105 HRA rules fall apart.

If you are a partner in a partnership, your spouse can be hired as a W-2 employee (assuming he or she has no ownership stake in the partnership), and then you can set up the QSEHRA for your spouse and any other W-2 employees.

For Partnership and S-Corp owners, your best bet is to take the Self-Employed Health Insurance Deduction. We explain more how to do that in the Next Steps section below. The good news is that you can still have your business pay for your health insurance premiums. From the IRS Form 1040 Instructions:

- If you are a partner, the policy can be either in your name or in the name of the partnership. You can either pay the premiums yourself or your partnership can pay them and report them as guaranteed payments. If the policy is in your name and you pay the premiums yourself, the partnership must reimburse you and report the premiums as guaranteed payments.

- If you are a more-than-2% shareholder in an S corporation, the policy can be either in your name or in the name of the S corporation. You can either pay the premiums yourself or the S corporation can pay them and report them as wages. If the policy is in your name and you pay the premiums yourself, the S corporation must reimburse you. You can deduct the premiums only if the S corporation reports the premiums paid or reimbursed as wages in box 1 of your Form W-2 and you also report the premium payments or reimbursements as wages on Form 1040, line 7.

If you have employees, you’ll want to set up a QSEHRA. Although you won’t be able to participate as an owner, you’ll be able to get all your employees’ eligible expenses recorded as a business expenses (Schedule C), which helps you reduce the self-employment taxes you’ll owe. So still a big win for you and a great benefit for employees! See the Next Step section for getting started.

Which health insurance is right for me?

I need to take the self-employed tax deduction

Great! It’s going to be important that you keep good records. You’ll want to understand what is deductible and what is not. Here’s a good list that can help you.

A good rule-of-thumb when thinking about whether something is deductible as a medical expense is to ask if something is medically necessary or just recommended? Doctor visits and prescriptions are typically necessary and therefore deductible while cosmetic surgery is usually not.

About the self-employed tax deduction

Note that there are two places you can take deductions on your personal taxes (Form 1040):

- The Self-Employed Deduction (Line 29)

- If you itemize your expenses (Line 40)

For the Self-Employed Deduction, it’s pretty straightforward, and the IRS provides a pretty good worksheet in the Form 1040 instructions for Line 29 so we won’t cover that here.

If you had significant expenses, you may be able to itemize those expenses and take an even larger deduction if your medical expenses were greater than 7.5% of your Adjusted Gross Income (AGI) in 2017 or 2018. This limit is expected to go up to 10% in 2019 and beyond. You should save good records and consult a tax professional or use tax preparation software to take the itemized deduction.

If you’re an S-Corp owner (more than 2% ownership) or partner in a Partnership and your company is paying for or reimbursing you for your health insurance premiums, make sure to follow the instructions discussed in the Partnerships & S-Corps section for reporting these reimbursements as on your W-2 or as guaranteed payments.

I need to set up a One-Person 105 HRA

Cool! The first thing you’re going to need are your legal plan documents. These are an absolute requirement. You can’t just start operating and reimbursing like a One-Person 105 HRA without having the proper documentation, but the documents don’t need to be expensive. You’ll want to talk to your attorney or accountant to see if they have any document templates available.

Next, you will need to come up with a receipt management system. Since it’s “all in the family”, privacy isn’t as big a concern as it is with QSEHRA, but you’ll want to get organized.

I need to set up a QSEHRA

Awesome! Similar to the One-Person 105 HRA, you’ll need legal plan documents, employee notices, and a system to substantiate employee claims without violating their privacy.

How to set up an HRA for small business

It’s not advisable to administer your own QSEHRA because of HIPAA, so you’ll want to go through a third-party administrator (like Take Command!). You can sign up any time, and a new HRA offering qualifies employees for a special enrollment period so they can sign up for their individual plan without waiting for open enrollment.

Setting one up is pretty straight-forward. Here’s what you need to do:

- Design your reimbursement plan

- Create your legal plan documents

- Set a start date and cancel any group health policies (if applicable)

- Provide required notices to your employees

Our comprehensive QSEHRA guide goes into detail on each of these steps.

84% of our clients spend less than an hour each month administering their HRA.

You’ll want to check out 3rd party services to help here. At Take Command, we’ve designed an online QSEHRA Administration service specifically for small employers. We’ll help you design your plan and create your plan documents. We have a low monthly subscription fee to manage employee receipts, create reimbursement reports, manage compliance, and help with year-end reporting. Employees can make claims by taking photos with their smart phones, so it’s pretty easy. We can also help employees find a health plan that covers their doctors and prescriptions if they need help.

Yes, we do have other competitors, but we hope if you have found this guide helpful, you’ll consider us. At the very least, we’re happy to talk with you and answer any QSEHRA questions you may have.

Let's talk through your HRA questions

Fill out the form below to connect with our team and see if an HRA is a good fit.

Hi, I'm Jack and I wrote this guide to help you make the most of your QSEHRA reimbursements. I had a lot of help from my team and our attorney too!

As a licensed health professional and leading QSEHRA expert, I've been published in the New York Times, Wall Street Journal, Forbes, and others on helping small employers realize the potential of QSEHRA. I am a small business owner and have an MBA from Wharton.

If you have any questions, please chat with me or my team or fill out the form below. Thanks for reading!