It turns out over 88% of Americans choose the wrong plan and end up wasting more than $500 a year. Don't let that be you! This post walks through how to save and make smart choices when deciding on individual health insurance for your family.

What is individual health insurance?

Individual health insurance, or private insurance, consists of plans that individuals and families can purchase on the Federal Exchange or Marketplace (also known as Obamacare) or their own state exchanges.

What is open enrollment?

Open Enrollment is the time between November 1st and December 15th when you can sign up for individual health insurance for the following year.

How to save on individual health insurance

Before you sign up for a plan, it's important to understand your best options, especially with all the changes in the market this year. Take Command is here to help you understand the health insurance market, see through the fine print, and make a smart decision.

Here's a couple things to keep in mind:

Doctor networks continue to stay small: An ongoing trend since the start of Obamacare, many plans will cover an increasingly smaller percentage of doctors in a given area. That leaves the consumer with fewer choices and a greater chance of having to go out of network to get the care they need. This is a strategy used by carriers to keep costs down, but it leaves consumers financially vulnerable for shouldering those scary and sky-high out-of-network costs. It's always smart to check every year if your doctor will remain on your network.

Premiums are still really expensive: While premiums decreased by 4% across the board, according to CMS, they are still too expensive for those who don't qualify for premium tax credits to off-set the costs. We see markets stabilizing and more and more options designed to help individuals afford health insurance. Here are a few things to keep in mind that are new to 2020 or in the past year.

If peace of mind and no hassle sound good to you, let's get started with a few insider tips on how to buy individual health insurance and get the most bang for your buck.

1. Always shop every year.

It’s tempting to want to stick with one plan out of convenience, and the thought of trying something new can be intimidating. Unfortunately, health insurance isn’t something that should be put on auto-pilot. Plans, doctor networks, prescription coverage and your family’s health needs are changing every year. Not to mention, the market is changing significantly due to several emerging trends: narrowing provider networks, rising premiums, insurers leaving the exchange and offering off-exchange only plans.

What was great one year may be terrible the next, and insurance companies are frequently shifting things around to maximize their earnings—not necessarily your health.

Here are a few things to keep in mind:

- NEVER let yourself get auto-renewed in a plan: 80% of plans will have a significant change each year that you may not be aware of.

- If you're leaving a company and COBRA is an option, 99% of the time, COBRA is a bad deal. Don’t just accept it because it’s easy. You can be billed for up to 102% of the total cost of coverage; 100% of the cost of your previous plan plus a 2% administrative fee!

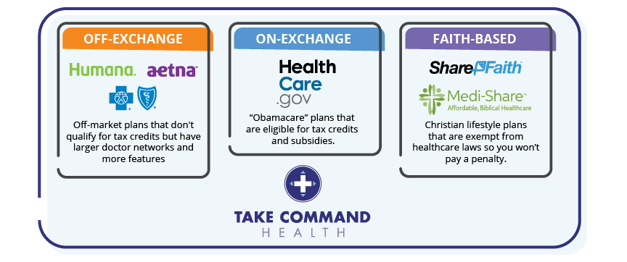

2. Look at ALL of your options

There are several ways to purchase health insurance. When you shop at Healthcare.gov, you’re only seeing “on-exchange” plans. However, insurance companies only make a fraction of their plans available “on exchange." If you go directly to an insurance company’s website, you’ll see their “off-exchange”plans. There are also private exchanges, co-ops, faith-based “medical sharing” plans, and even short-term plans that function similar to insurance. At Take Command, we can help you quickly see ALL of your options.

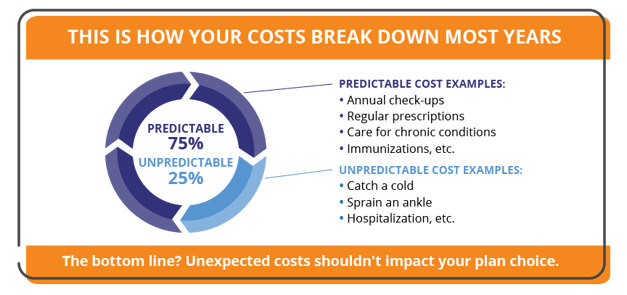

3. Estimate your out-of-pocket expenses.

Statistically, over 75% of your costs in the next year are predictable based on your known needs.

What really drives costs, and therefore your plan choice, are the things you know about: prescriptions, doctors visits, therapy, medical equipment, etc. If you’re healthy, maybe you plan on none of these things–which is just as important to know.

At Take Command, you can quickly search for your prescriptions or tell us about any health needs you are managing such as “physical therapy” or “having a baby.”

We’ll run all the numbers for you and help you estimate your out-of-pocket costs on each plan!

Brilliant!

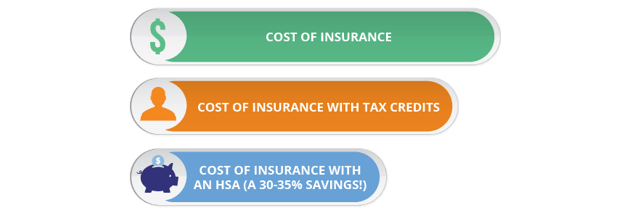

4. Take advantage of tax credits, HSAs, and HRAs

One way to pay too much for health insurance is to leave money on the table. We see many individuals assume they're not eligible for tax credits when they actually are. Depending on where you live, a family of 3 or 4 that makes $90,000 a year will likely qualify for a tax credit.

If you do make too much money for a credit, then you should probably consider using a Health Savings Account (HSA), like the Lively HSA we offer for free with our premier membership. HSAs allow you to pay for your care with tax-free dollars. For high-earners in a higher tax bracket, that’s like a 30 to 35% discount on health costs!

With new regulatory rules in place, employers have more flexibility to reimburse employees with cash-for coverage, meaning they can reimburse their teams for individual marketplace health plans. This is great news! Here are the details on the two latest HRAs.

- ICHRA- individual coverage HRAs are going to be a game-changer. They are a flexible, customizable, tax-free option. Employees choose any plan they want from the individual marketplace to qualify for participation.

- EBHRA- excepted benefits HRAs allow for higher levels of employer contributions than flexible spending arrangements (FSAs) and the unused funds can rollover year to year. These can be used to cover the cost of copays, deductibles, or other costs not covered by the plan.

- QSEHRA- no longer the new kid on the block, this HRA has steadily grown in popularity.

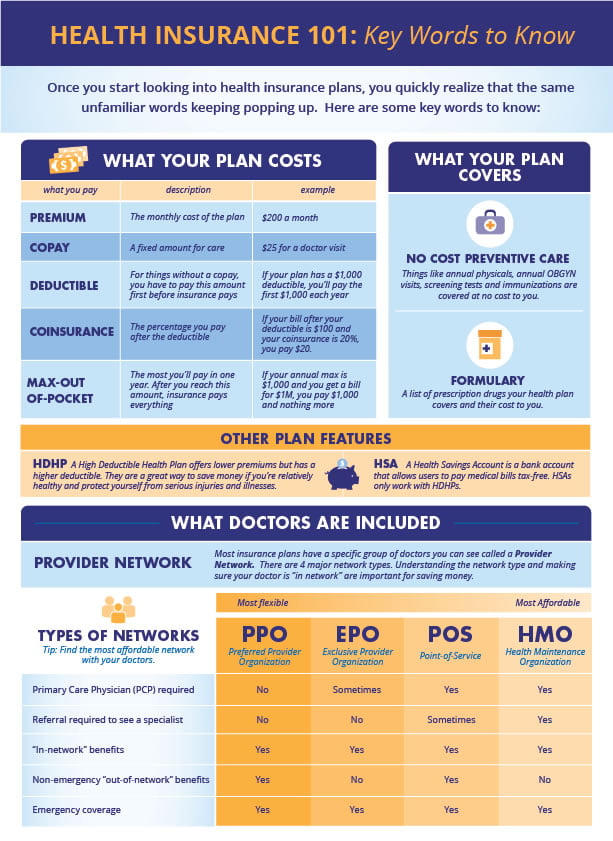

5. Learn the lingo

The language of health insurance is familiar and confusing at the same time. Words like deductible, premium, copay, etc. get thrown around in conversations with colleagues and by really sophisticated marketers that the insurance companies hire. Before you start comparing plans, take a few minutes to understand these important insurance terms.

6. Keep your doctors “in network”

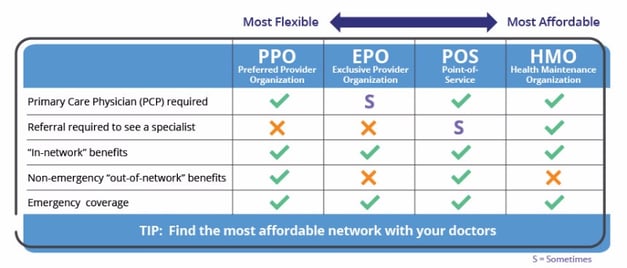

Keeping your favorite doctors "in network" is critical to saving money. If you try to see a doctor that is out of network, your health plan won't help very much or may not pay anything at all. Many people are familiar with "PPOs" and "HMOs" but there are actually several options in between that are worth considering.

While PPOs provide the most flexibility, they are also the most expensive. If your doctors happen to be in an HMO or if you don’t have preferred doctors yet, the HMO can be a great money saving choice. These aren’t the HMOs of the past with long wait times and long lines. You can get referrals online (check with your provider) and going to see some specialists (like an OBGYN) no longer requires a referral.

We've built the first universal doctor search tool that lets you quickly search for your doctor across all plan types and networks.

Don't waste time digging through each insurance company's site or calling every doctor. When you go through our survey at Take Command, we'll help you search for your doctor or you can use our stand-alone doctor search tool to quickly search for your doctor.

Common pitfalls to avoid

We want you to feel like an expert and that means understanding how these terms really impact plan choice. Here are a few of the most common pitfalls we see each year:

“I need a plan with a low deductible”

We’re programmed to think that we don’t get anything before the deductible (in all fairness, it was this way for many years). However, with individual plans, all of your preventive care is covered before the deductible. That means all of your annual physicals, screenings, immunizations, flu shots, etc. cost $0. You could see the doctor multiple times a year, get monthly prescriptions, and never touch your deductible because you don't need to. Plans with low deductibles are very expensive and rarely best. Instead, focus on more important numbers like estimating your cost of care and the max-out-of-pocket limit.

“I need a low copay”

Insurance companies have done lots of research and know that individuals pay the most attention to a plan’s deductible and primary care visit copay when choosing a health plan—and they will use fancy marketing to trick you. Aetna had a series of plans recently with names like the “Aetna $15 copay Bronze Plan.” Here’s what happens. The $15 covers the cost of the doctor visit only. Literally, just the 20 minutes the doctor spends talking to you. Recall from above, if you’re seeing the doctor for a screening or annual physical, this is $0. If you’re sick or injured, you’ll almost certainly need a strep test, bandages, lab work, etc. that is not subject to the $15 copay. We see clients get frustrated by $200 bills that they thought were going to be $15.

In addition, copays do not count towards your deductible. That’s a huge surprise to most folks, but we promise it’s true. If you have a plan with a $1000 deductible and a $500 ER copay and have to go to the ER for something minor, you’ll pay $500 no matter what (even if it wouldn’t have been that much if you just paid cash) and will have paid $0 towards your deductible.

“I need a plan that covers my prescription”

Here’s a good rule of thumb: if you take a name-brand medication, then, yes, you do need to make sure it’s covered by your plan. However, most maintenance drugs are available in generics. Many people think they take a name brand when they’ve actually been taking the generic for years. Most generics have a very affordable cash price. We had one client—a very nice lady—who insisted she needed an expensive Silver plan that was going to cost her $250 more a month because it had a $15 copay for her drug. Well, we found her drug cost $8 cash at her local pharmacy. Make sure to check the cash price of your prescriptions!

“I need a PPO”

Maybe you do, but you may also be way over-paying.

“My doctor won’t take any ‘exchange’ (Healthcare.gov) plans”

We hear this a lot, often from front-office staff or doctors who may be great physicians but don’t understand their insurance contracts. The reality is that doctors (or their hospital systems in some cases) negotiate with insurance companies, not with plans that are on or off-exchange. If your doctor has negotiated with an insurance company to accept one of their networks, it doesn’t matter if you buy your plan on the exchange (Healthcare.gov) or on a private exchange.

Take Command is here for you

Take Command is here to empower you to be a smart shopper when it comes to your health insurance. Our online tool is free, easy to use and takes five minutes. We are data driven, innovative, and trying to shake up the health insurance industry. Give it a try!

Have a question? You can always email us at support@takecommandhealth.com too and we'd be pleased to help.

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!