Running a small business in Minnesota comes with its own set of challenges and opportunities. As a small business owner, one key consideration is providing health insurance for your employees. Comprehensive health insurance attracts and retains talented employees and demonstrates your commitment to their well-being. In this guide, we'll explore the options and considerations for health insurance for small businesses in Minnesota, helping you make informed decisions that benefit your employees and your business.

Benefits of Providing Minnesota Small Business Health Insurance

Offering Minnesota small business health insurance to your employees has numerous benefits for your small business. Here are a few of our favorites.

1. Employee Attraction and Retention

More than half of small businesses aren't offering health benefits and are losing talent. In today's competitive job market, talented professionals seek more than just a paycheck. They want to work for companies prioritizing their well-being and offering benefits beyond the basics. By providing comprehensive health insurance, you send a clear message to potential employees that you value their health and are committed to long-term success. This can give you a competitive edge in attracting and retaining top talent in your industry.

2. Improved Employee Well-Being

Access to quality healthcare leads to improved overall health and well-being for your employees, resulting in increased productivity and job satisfaction. When employees have access to regular medical check-ups, preventive care, and timely treatment, they are likelier to stay healthy and address any health concerns early on. This reduces the risk of serious illnesses and helps employees manage chronic conditions effectively. As a result, they can perform their job duties more efficiently and with greater focus, leading to increased productivity.

3. Positive Work Environment

Providing health insurance demonstrates that you care about your employees' health and fosters a positive workplace culture. When employees know that their employer values their well-being and is invested in their health, it creates a sense of trust and loyalty. This, in turn, leads to a more positive work environment where employees feel supported and motivated to perform at their best.

4. Tax Advantages

Small businesses may qualify for tax credits when offering health insurance to employees, helping offset the costs. This can be a significant advantage for small businesses in Minnesota, as it allows them to provide comprehensive health insurance without incurring excessive expenses. One option that small businesses can consider is using Health Reimbursement Arrangements (HRAs). With HRAs, reimbursements for employee health insurance expenses are not subject to payroll, employer, or income tax.

5. Business Reputation

Offering health insurance enhances your business's reputation as a responsible and caring employer in the community. Not only does it demonstrate your commitment to your employees' well-being, but it also showcases your dedication to supporting the local community. By providing comprehensive health insurance, you are not only investing in your business's success but also contributing to the overall health and prosperity of your employees and their families. By prioritizing the health and well-being of your employees, you are investing in the long-term success and growth of your small business in Minnesota.

Health Insurance Landscape for Small Businesses in Minnesota

Minnesota offers various health insurance options for small businesses, including the following:

Small Group Health Insurance Minnesota

Small businesses can purchase small group health plans from insurance carriers. These plans are designed specifically for groups of employees and offer a range of coverage options. These can be expensive, one-size-fits-all, and subject to high renewals.

Several options are available when providing health insurance coverage for your small business employees in Minnesota. Understanding the differences between these plans can help you make the right choice for your team's healthcare needs. Let's delve into the four main types of small group health plans: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point-of-Service Plans (POS).

Health Maintenance Organizations (HMOs)

Health Maintenance Organizations, or HMOs, offer comprehensive coverage focusing on preventive care. With an HMO plan, employees typically choose a primary care physician (PCP) from a network of healthcare providers. This PCP coordinates all of their medical care and referrals to specialists within the network. HMOs usually require members to obtain all their healthcare services from network providers, except in cases of emergency care.

HMO plans often have lower premiums and out-of-pocket costs than other plans. However, they may have more limited provider networks, and members may need referrals to see specialists.

Preferred Provider Organizations (PPOs)

Preferred Provider Organizations, or PPOs, offer more flexibility in choosing healthcare providers. Employees covered under a PPO plan can see any doctor or specialist they choose, inside or outside the plan's network, without a referral. However, utilizing in-network providers typically results in lower out-of-pocket costs for the employee.

PPO plans often have higher premiums compared to HMOs but provide greater flexibility in accessing healthcare services. They are a popular choice for businesses that want to offer their employees a balance between choice and cost savings.

Exclusive Provider Organizations (EPOs)

Exclusive Provider Organizations, or EPOs, combine elements of both HMOs and PPOs. Like HMOs, EPOs typically require members to select a primary care physician and obtain referrals to see specialists within the network. However, unlike HMOs, EPOs do not usually cover out-of-network care except in emergencies.

EPO plans often offer competitive premiums and may appeal to businesses seeking cost-effective options with a moderate level of provider choice.

Point of Service Plans (POS)

Point-of-service plans, or POS plans, combine features from HMOs and PPOs. Employees covered under a POS plan typically choose a primary care physician from a network of providers and can seek care from specialists within or outside the network. However, out-of-network care usually comes with higher out-of-pocket costs.

POS plans offer flexibility in choosing healthcare providers while still providing some cost-saving incentives for using in-network services.

In conclusion, selecting the right small-group health plan for your Minnesota-based business involves considering cost, provider networks, and level of flexibility. Whether you opt for an HMO, PPO, EPO, or POS plan, offering comprehensive health insurance coverage can help attract and retain talented employees while promoting their well-being.

Health Insurance Marketplace (MNsure)

MNsure is Minnesota's health insurance marketplace, where small businesses can explore and purchase health insurance plans that meet Affordable Care Act (ACA) requirements.

SHOP Marketplace

The Small Business Health Options Program (SHOP) Marketplace is a component of Healthcare.gov that allows small businesses to compare and purchase health insurance plans for their employees.

Health Reimbursement Arrangements

Instead of dealing with one of the above options, business owners can simply reimburse employees for individual health plans purchased at Healthcare.gov or the State Exchange. It's tax-free, hands-off, and affordable. Employees receive personalized health plans that best suit their unique needs.

Self-funded Health Plans

Small businesses in Minnesota have the option of self-funded health plans, where the employer directly assumes the financial risk for providing healthcare benefits. These plans directly fund healthcare claims, allowing employers to tailor benefits to suit their workforce's needs. With self-funded plans, employers have flexibility in plan design, including customization options for benefits, wellness programs, and cost-saving measures. However, employers must carefully manage financial risks by monitoring costs, implementing strategies, and often securing stop-loss insurance to mitigate potential high claim costs or adverse selection.

Third-party administrators (TPAs) can assist with plan administration, including claims processing and compliance. Self-funded plans offer potential cost savings compared to fixed premiums, as employers only pay for actual claims incurred by their employees. Additionally, self-funded plans provide greater transparency into healthcare costs, allowing informed decision-making for cost savings. Moreover, they offer opportunities for employee engagement through wellness programs and incentives for healthy behaviors.

Despite these benefits, employers must be aware of the administrative burden associated with self-funded plans, which may require additional resources despite TPAs' assistance. Self-funded health plans offer small businesses in Minnesota flexibility and potential cost savings, but they come with financial risks and administrative responsibilities that require careful management.

HSAs

Health Savings Accounts (HSAs) offer tax-advantaged savings for medical expenses. Paired with high-deductible health plans (HDHPs), HSAs allow individuals to contribute pre-tax dollars, reducing taxable income. Contributions by employers are also tax-deductible. HSAs cover qualified medical expenses, including deductibles and co-payments. Funds roll over annually and can be invested for growth, offering portability and long-term savings potential. Employers can contribute to employees' HSAs, promoting cost-conscious healthcare decisions and financial wellness. However, understanding eligibility, contribution limits, and qualified expenses is crucial. Overall, HSAs provide flexibility and tax benefits for both employers and employees.

Direct Primary Care (DPC)

Direct Primary Care (DPC) is an innovative healthcare model gaining popularity among small businesses in Minnesota. In a DPC arrangement, patients pay a flat monthly fee directly to their primary care physician or practice in exchange for comprehensive primary healthcare services. This fee covers various services, including office visits, preventive care, chronic disease management, and basic diagnostic tests.

DPC eliminates the need for traditional health insurance for primary care services, offering patients more accessible and affordable healthcare while fostering a stronger doctor-patient relationship. DPC practices can offer longer appointment times, same-day or next-day appointments, and enhanced care coordination by bypassing insurance billing and administrative overhead.

For small businesses, offering DPC memberships to employees can lead to cost savings, improved access to care, and higher employee satisfaction with their healthcare benefits. However, employers and employees must understand that DPC is not a substitute for comprehensive health insurance coverage and should be complemented by a catastrophic health plan to cover major medical expenses.

Overall, DPC presents an attractive alternative to traditional primary care delivery models, emphasizing personalized, high-quality care at an affordable price.

Considerations When Choosing Small Business Health Insurance Minnesota

Selecting the right small-group health insurance plan Minnesota requires careful evaluation. Here are key considerations to keep in mind:

1. Plan Options:

- Evaluate the different types of health insurance plans available, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High-Deductible Health Plans (HDHPs).

2. Network Coverage:

- Check if the plans include a network of healthcare providers and hospitals convenient for your employees.

3. Cost Sharing:

- Consider the premium costs, deductibles, co-payments, and coinsurance your employees and your business will be responsible for.

4. Essential Health Benefits:

- Review the essential health benefits covered by the plans, ensuring they meet the ACA requirements and provide the necessary coverage for your employees.

5. Employee Input:

- Seek input from your employees to understand their health insurance needs and preferences. This can help you choose a plan that aligns with their requirements.

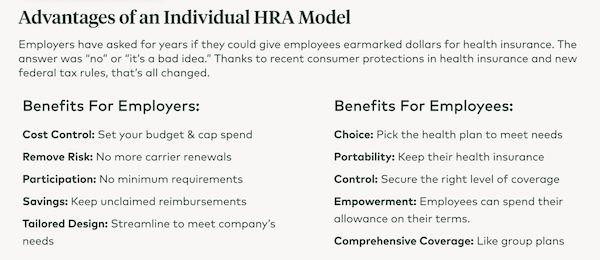

Why HRAs Stand Out for Small Business Health Insurance Minnesota

In the diverse landscape of employee benefits, Health Reimbursement Arrangements (HRAs) emerge as a beacon of innovation and flexibility for small businesses in Minnesota. With the healthcare landscape constantly evolving, small businesses seek solutions that provide value to their employees and align with their budgetary constraints and administrative capabilities. HRAs offer compelling benefits, distinguishing them from traditional health insurance models. Explore why HRAs are becoming increasingly popular among Minnesota's small businesses.

Flexibility and Customization

One of the most significant advantages of HRAs is their unparalleled flexibility and customization. Unlike traditional health insurance plans with a one-size-fits-all approach, HRAs allow small businesses in Minnesota to design a benefits package that fits the unique needs of their workforce. Employers can set their own budget by deciding how much to contribute annually to each employee's HRA account. This flexibility ensures that businesses can provide valuable health benefits without overspending, making HRAs an ideal solution for companies with a diverse workforce having varied health needs.

Employee Choice

HRAs empower employees to choose their healthcare services and products. This employee choice is particularly beneficial in a state like Minnesota, where healthcare needs and preferences can vary widely across individuals. With an HRA, employees are no longer restricted to traditional employer-sponsored plans' network limitations and coverage constraints. Instead, they can use their allocated HRA funds to purchase individual health insurance policies that best meet their personal and family's healthcare needs, including out-of-network doctors and alternative therapies that might not be covered under standard plans.

Cost Efficiency

For Minnesota's small businesses, managing operational costs effectively is crucial for sustainability and growth. HRAs present a cost-efficient solution to offering employee benefits. By utilizing HRAs, employers can control health benefits costs by setting predetermined contribution amounts to each employee's HRA. This approach eliminates the unpredictability of rising insurance premiums and provides a straightforward way to budget for employee benefits. Furthermore, contributions made to an HRA are tax-deductible for the employer, adding additional financial efficiency.

Compatibility with Premium Tax Credits

A unique feature of certain types of HRAs, like the Individual Coverage HRA (ICHRA), is their compatibility with premium tax credits under specific conditions. This is particularly advantageous for employees in Minnesota who might qualify for premium tax credits when purchasing individual health insurance through the marketplace. The arrangement allows for a seamless integration of HRA benefits with the subsidies available through the Affordable Care Act (ACA), ensuring that employees can maximize their benefits while minimizing out-of-pocket expenses.

Simplicity and Ease of Use

Finally, HRAs stand out for their simplicity and ease of use for employers and employees. Setting up and managing an HRA is straightforward, with minimal administrative burden compared to traditional group health plans. This simplicity is a significant boon for Minnesota small businesses without dedicated HR departments. For employees, accessing HRA funds is typically as simple as purchasing qualifying healthcare products or services and submitting proof of their expenses for reimbursement. This ease of use ensures that employees can fully utilize their health benefits without navigating complex insurance policies or networks.

In conclusion, HRAs offer a unique combination of flexibility, employee choice, cost efficiency, compatibility with premium tax credits, and simplicity that stands out in the Minnesota small business landscape. As small businesses continue to navigate the challenges of providing valuable employee benefits, HRAs represent a versatile and effective solution that aligns with the needs of both employers and employees. Take Command is at the forefront of harnessing these benefits, guiding Minnesota small businesses toward a future where health benefits are more personalized, accessible, and financially sustainable.

HRAs, the better option for Minnesota Small Business Benefits

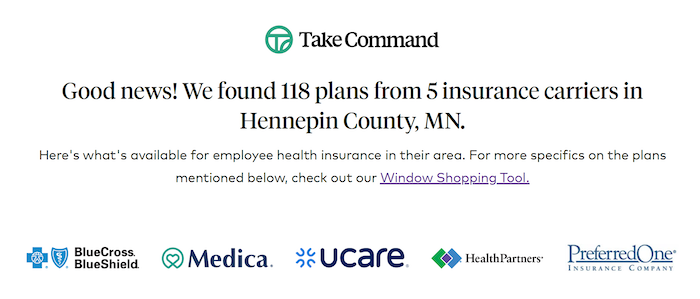

Minnesota business owners should consider HRAs for a few reasons. First, they can control costs and take care of their employees. Second, Minnesota has an incredible individual health insurance market with innovative carriers, plans with perks, and many options. Here are a few questions we hear often.

What can my employees buy?

Minnesota boasts one of the country's most competitive individual health insurance markets. Therefore, the state was one of the earliest adopters of these new HRA models.

Source: Take Command's Market Snapshot Tool

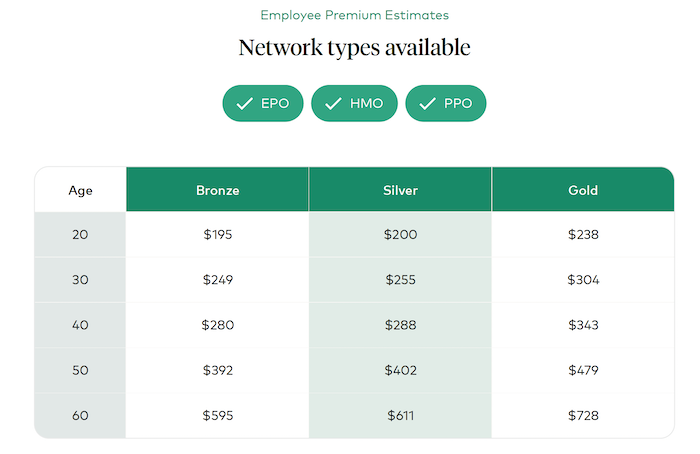

Are they quality health plans?

Minnesota small business employees are not limited to HMOs. There are EPOs, HMOs and PPOs depending on the level of coverage they need. And remember, all of these plans are high-quality health insurance that meets the standards required by the Affordable Care Act, including covering preexisting conditions and ten essential health benefits.

Source: Take Command's Market Snapshot Tool

Source: Take Command's Market Snapshot Tool

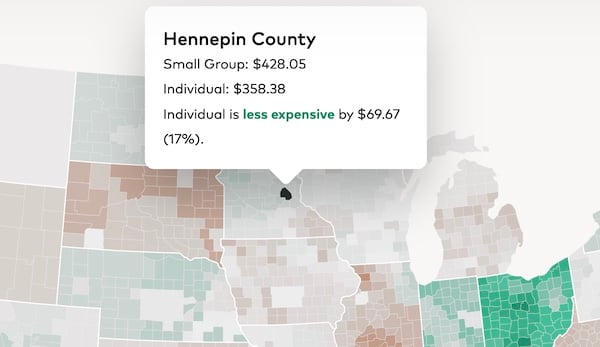

Get more out of your benefits budget with HRAs

Here's an example of Hennepin County. While $69 might not sound like a ton of savings, just remember that is per month and per employee.

Individual rates are 14% cheaper than group in Minnesota's three largest counties.

Source: HRA Heat Map

Minnesota Small Business Health Insurance Requirements

Navigating the health insurance landscape can be complex for small business owners in Minnesota. Understanding whether health insurance is legally obligated to be provided is crucial for compliance, strategic planning, and budgeting. Here's what small businesses in Minnesota need to know about their requirements regarding health insurance.

Do Small Businesses Have to Offer Health Insurance in Minnesota?

In Minnesota, as in the rest of the United States, the Affordable Care Act (ACA) plays a significant role in determining whether small businesses need to offer health insurance to their employees. According to the ACA, small businesses with fewer than 50 full-time equivalent employees (FTEs) are not mandated to provide health insurance to their employees. This rule applies broadly across Minnesota, giving small business owners the flexibility to choose whether or not to offer health benefits.

However, this doesn't mean small businesses should disregard health insurance. Offering health insurance can be a strategic move for several reasons:

- Attracting and Retaining Talent: Health benefits are a significant factor for many individuals when choosing an employer. Small businesses that offer health insurance may have an edge in attracting and retaining top talent.

- Tax Advantages: Small businesses that choose to provide health insurance can enjoy tax benefits. For instance, premiums paid on behalf of employees can often be deducted from business income, lowering the overall tax burden.

- Employee Health and Productivity: Providing health insurance can lead to healthier employees, which, in turn, can increase productivity and reduce absenteeism due to illness.

For small businesses in Minnesota that decide to offer health insurance, there are several options available:

- Small Business Health Options Program (SHOP): This is a marketplace created by the ACA specifically for small businesses with 1 to 50 employees. It offers a variety of plans that can help small business owners provide health and dental insurance to their employees.

- Private Health Insurance Providers: Small businesses can purchase health insurance directly from private insurers. This option might offer more flexibility in terms of plan choices and customization.

- Health Reimbursement Arrangements (HRAs): As mentioned previously, HRAs allow small businesses to reimburse employees tax-free for their health insurance premiums and other medical expenses, offering a flexible alternative to traditional group health insurance plans.

While small businesses in Minnesota are not required to provide health insurance, doing so can benefit both the employer and the employees. Small business owners should carefully consider their options and workforce needs when making decisions about health insurance. Consulting with a professional or exploring resources available through the Minnesota Department of Commerce and other state-specific organizations can provide valuable guidance tailored to individual business needs.

FAQs For Minnesota Small Business Health Insurance

Navigating the complexities of health insurance can be challenging for small business owners in Minnesota. To help demystify the process, we've compiled a list of frequently asked questions that can guide employers through the nuances of providing health insurance, with a particular focus on Health Reimbursement Arrangements (HRAs).

How much does small business health insurance cost in Minnesota?

The cost of small business health insurance in Minnesota varies widely depending on several factors, including the size of the business, the age and health of the employees, the level of coverage provided, and the insurance provider chosen. On average, small businesses can expect to pay anywhere from several hundred to over a thousand dollars per employee monthly for health insurance premiums. However, these costs can be mitigated through careful plan selection, leveraging tax advantages, and exploring different funding mechanisms like HRAs. To get a precise estimate, businesses should obtain quotes from multiple insurance providers or consult a small business health insurance broker.

What administrative requirements do I have as a Minnesota employer if I want to offer an HRA?

To offer a Health Reimbursement Arrangement (HRA) in Minnesota, employers must comply with specific administrative requirements set by the IRS and the Department of Labor. These include:

- Plan Documentation: Employers must provide written documentation of the HRA plan to all eligible employees, outlining the terms and conditions of the benefit.

- Non-Discrimination: HRAs must be offered on the same terms to all eligible employees, adhering to non-discrimination rules to ensure fairness.

- Recordkeeping: Employers must keep detailed records of reimbursements made under the HRA for tax purposes and prove compliance with regulations.

- Privacy Compliance: The handling of personal health information must comply with the Health Insurance Portability and Accountability Act (HIPAA), which requires specific privacy protections.

Using a platform or service that specializes in administering HRAs is advisable to ensure compliance with all regulations and streamline program management.

What expenses are not eligible for HRA Reimbursement?

While HRAs offer broad flexibility in what health-related expenses can be reimbursed, specific exclusions are mandated by the IRS. Generally, non-eligible expenses include:

- Non-medical expenses: Costs unrelated to medical care, such as gym memberships (unless prescribed for a specific medical condition), health club dues, or non-prescription cosmetics.

- Premiums for Non-Health Insurance: This includes premiums for life insurance, disability insurance, and other types of non-health insurance coverage.

- Over-the-counter medications without a prescription: Though there are exceptions, most over-the-counter drugs and medicines need a prescription to be eligible for reimbursement.

- Expenses reimbursed by another plan: Expenses that have been or can be reimbursed under another health plan are not eligible.

For the most current list of eligible and ineligible expenses, employers should refer to IRS guidelines or consult a tax professional.

Ready to get started?

Reimbursing your employees tax-free through a Health Reimbursement Arrangement (HRA) has never been easier. With our HRA administration platform, you can design and launch your QSEHRA plan in minutes.

-

Manage benefits for an hour or less per month

-

Offer health insurance on your budget & save on taxes

-

Boost recruitment and retention in a tight hiring market

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!