Note: This guide was originally published in 2017 and has been updated with the latest data and regulatory changes for 2025.

What is QSEHRA?

QSEHRA (pronounced “Q-Sarah” for fun) is a new, more efficient way for small businesses and non-profits to offer health insurance to their employees. It’s a game-changer that many are just now discovering.

QSEHRA definition

A QSEHRA is an arrangement that allows employers (with 50 employees or less) to set aside a fixed amount of money each month that employees can use to purchase individual health insurance or use on medical expenses, tax-free. This means employers get to offer small business health insurance benefits in a tax-efficient manner without the hassle or headache of administering a traditional group plan and employees can choose the plan they want.

The general idea is this: employers simply reimburse employees when a health expense occurs. There is no pre-funding of accounts. If employees don't submit receipts for reimbursement or do not need medical care, the leftover funds stay in the employer's pocket.

To cut quickly through the insurance jargon (it stands for “Qualified Small Employer Health Reimbursement Arrangement” by the way), a QSEHRA health insurance allows small employers to set aside a fixed amount of money each month that employees can use to purchase individual health insurance or use on medical expenses, tax-free. This means employers get to offer benefits in a tax-efficient manner without the hassle or headache of administering a traditional group plan and employees can choose the plan they want. This new model of benefits allows employer contribution to health insurance that fits their budget and their employees' needs.

The challenge? QSEHRA health insurance is still fairly new in the marketplace and many people haven’t heard of them. Or if they have, they’re not sure where to start. That’s why we put together this guide. We want to make QSEHRA really easy to understand and really easy to setup.

This 2025 guide is designed to help small employers unlock the huge savings potential of QSEHRA.

This guide is for small business owners and non-profit directors interested in learning about QSEHRA and for accountants, attorneys, consultants, brokers, and book-keepers looking to help their clients who are looking for health insurance for small business.

An important disclaimer: We’re licensed health agents and experienced QSEHRA practitioners, but we are not licensed tax professionals—please don’t treat our advice as such. We’ll share our practical knowledge and provide links to all the IRS regulations and legal resources you need if you want to dive in further. Sound good? Let’s jump in!

In this guide, we’ll share:

- Overview and summary (read this if you only have a few minutes)

- Benefits

- Requirements for employers and employees

- Reimbursement rules and design tips

- How to setup and get started

- Administration and compliance

- FAQs and additional guidance and resources

Wondering how you could design your QSEHRA?

How QSEHRAs work

Quick summary: Employees pay for health expenses, you reimburse them tax-free.

How does QSEHRA work?

The mechanics of QSEHRA health insurance are surprisingly simple. At a high-level, employees pay for their own health expenses and you reimburse them. Here’s how it works:

- Employers design their plan and set reimbursement allowances

- Employees pay for their own health insurance and medical bills

- Employees provide proof of their expenses

- Employers reimburse the employee up to the set limit

The key to note is payments are reimbursements. Employees will pay the insurance company or doctor’s office directly and then submit a claim to get reimbursed for their expenses tax-free.

We often get questions from employers concerned about their employees having to cover high insurance premium costs on their own before receiving a reimbursement. To help, you can adjust the timing of reimbursements and setup automatic reimbursements through payroll. This way, you can get funds to your employees’ accounts before the bill is due.

A QSEHRA is not a bank account. This can be a little confusing at first, but it’s actually much simpler. Unlike Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) that are accounts, the “HRA” in QSEHRA stands for Health Reimbursement Arrangement. We often get asked if business owners have to pre-fund their account or send money to our account so we can distribute it to their employees. The answer is no to both questions—the money stays with the employer until an employee makes a claim that qualifies for reimbursement. If employees never make claims or don’t claim the full amount, the employer keeps it all!

That said, if an employer or their accountant wants to setup a separate bank account to handle reimbursements, he or she is certainly welcome to but there is no requirement. As far as how to make reimbursements to employees, we recommend pushing through tax-free reimbursements on payroll (like you’re reimbursing for travel expenses or something). We’ve seen some business owners just write checks, pay cash, or use PayPal, etc. Up to the business owner! Learn more about how to make reimbursements through payroll systems.

A brief history of QSEHRA tax-free reimbursements

Before we go too far though, it’s helpful to understand where QSEHRAs came from and why you may need one. We meet many small business owners (often introduced to us by their CPA) who are currently reimbursing employees for health insurance. “Can’t I just reimburse my employees for their health insurance and ‘expense it’ as a business expense?”.

Can't I just reimburse my employees for their health insurance and expense it?

The quick answer to the question above is “no”, at least not tax-free without some serious tax consequences. The IRS is going to treat those reimbursements as income and insist that the employer pay payroll taxes and the employees recognize income tax.

The reality is tax free reimbursement used to be a common practice for small business owners. However, when the Affordable Care Act (ACA, a.k.a. “Obamacare") passed in 2010, the law had the unintended consequence of disallowing tax-free reimbursement for small companies. The primary hang-up was an interpretation that any company that reimbursed for health insurance (including individual) was technically a group plan. According to the ACA, group plans are required to provide preventive care at no cost. Since employers that reimbursed for individual plans did not meet the preventive care requirements, they would be subject to group plan penalties of up to $100 per employee per day. Yikes! See IRS Notice 2013-54.

The IRS, recognizing the adverse impact this interpretation would have, issued guidance to small business owners saying “Hey! We see this problem but we’re not going to enforce it until June 2015. Congress—you all need to fix this before then or we’ll have no choice but to enforce.” As you know, the political atmosphere around Obamacare prevented any of these fixes from taking place. As a result, in late 2015 the IRS started enforcing the provision and leveraging hefty fines and penalties for companies caught reimbursing for individual health insurance. See IRS Notice 2015-17.

The new “thing” to save the day: QSEHRA (aka the Qualified Small Employer Health Reimbursement Arrangement)

The insurance environment looked bleak for small employers in 2015 and 2016. Thankfully, however, the Small Business Administration and others continued to lobby congress to fix this problem. As a result, at the very end of President Obama’s 2nd term in December of 2016, a hodge-podge bill called the 21st Century Cures Act was passed with a provision creating the QSEHRA.

The irony is at the height of the political debate in 2017 about healthcare reform, the 21st Century Cures Act snuck through and became law without many people noticing. It was endorsed by both Republicans and Democrats and was largely seen as a fix to the unintended consequences of the ACA and a “small business friendly” provision. Similar “defined contribution” structures were included in most major Republican healthcare reform plans. We think this is important for prospective QSEHRA users to know—while healthcare reform efforts could pick up again and things could change, the highly bi-partisan nature of support for the 21st Century Cures Act means it’s probably not going away anytime soon. Plus, if large businesses can get health insurance tax-free, why can't small ones? Feels like common sense.

Now in 2025, we've see QSEHRAs take off exponentially since they began. We expect to see that same growth continue.

Implementing a QSEHRA in 2025 can unlock several big benefits for a small business or non-profit compared to other options. Here are some of the benefits and reasons why we love them:

Optimized Benefits

Before QSEHRA, a small employer’s only option if he or she wanted to provide health benefits was to offer a traditional, one-size-fits-all group health plan. If the boss chooses Blue Cross, everyone gets Blue Cross. It’s like forcing everyone at your company to wear the same size suit:

Figure 2: For employers with less than 50 employees, getting a group plan is like forcing everyone to wear the same sized suit. Don't be like this group!

In contrast, a tax-free reimbursement plan is much more optimized. By giving cash tax-free, employees can choose their own plan. If one employee wants Blue Cross because it has his doctor in network, great! If another employee wants to move to Aetna because it handles her prescription better, no problem! Finally, if another employee already gets great coverage through his spouse, he can stay on that plan and use the reimbursements to help with medical bills.

If the plan is designed to allow for medical expense reimbursement too, employees can spend it on whatever they need (contacts, prescriptions, dental care, etc). Reimbursements go directly towards meeting employee needs, not into a pit of group plan deductibles and premiums. And if an employee doesn’t need a reimbursement, the company keeps the money. No “use or lose”. Where a traditional group plan locks people in to plans that may not fit them, a QSEHRA gives employees options and flexibility and results in greater optimization.

Combine your QSEHRA plan with a solution like Take Command's enrollment software that helps your employees discover more plans that are optimized for their needs. This ensures your dollars are being spent efficiently and that your employees are buying plans they are happy with.

What every accountant should know about QSEHRA

Tax Efficiency

How does a QSEHRA compare tax-wise to other options? It puts the employer's reimbursements on nearly the same tax playing field as traditional small group plans, but without all the hassles and requirements. Before, a big advantage for group plans was that they were deductible expenses for employers and were taken out of employee paychecks on a pre-tax basis.

With QSEHRA, employers can make reimbursements without having to pay payroll taxes and employees don’t have to recognize income tax. In addition, reimbursements made by the company count as a tax deduction. Pretty awesome!

The only reason QSEHRA is not on the exact same level as group plans is if an employee wants to “buy up” to higher coverage. For example, if an employer offers employees $400/mo but an employee wants to buy the $600/mo health plan, the remaining $200/mo comes from the employee using his or her after-tax dollars, whereas on some group plans employees could buy up with pre-tax dollars.

Can I just give my employees a “health stipend”?

For companies that help employees with health insurance by offering a “health stipend” or by “adding to employee salaries”, tax-free reimbursement will typically have a huge tax advantage. For example, compare the tax consequences of a 10 person company offering employees $300/mo (so $3,000/mo in total reimbursement) by increasing salaries versus tax-free through a QSEHRA:

| Taxes & Fees | Taxable "Health Stipend" | QSEHRA |

|---|---|---|

| Reimbursement Amount | $3,000 | $3,000 |

| Employee Income Tax (~25%) | $750 | $0 |

| Employer Payroll Tax (~15%) | $450 | $0 |

| Total Monthly Taxes | $1,200 | $0 |

Table 1: Tax Savings Example

The result is that offering reimbursements through salary crush the value of the “stipend”, with over 30% of the value ($1,200/mo in this example) being wiped out in taxes. Ouch. However, with tax-free reimbursement, employees get to use the full value for their health insurance and medical expenses.

Flexible Design

QSEHRA provides immense flexibility over other benefit options. We’ll cover some of the mechanics in the requirement section but here we will focus on the benefits. For starters, in most states, group plans require employers to contribute at least 50% of the employee-only costs and require at least 75% of employees to participate. This approach can be extremely burdensome and “group savings” typically don’t kick in until an employer has over 100 employees. With a QSEHRA, there are no minimum contributions required or participation rates to maintain.

In addition, employers can typically design their QSEHRA to fit their business needs. While employers have to treat full-time employees fairly, there are a lot of levers they can pull on how much to reimburse and who gets to participate. For example, employers can vary reimbursement rates by married status. They can also chose whether to include or exclude part-time and seasonal workers. For more design options, see Reimbursement Rules below.

Budget Control

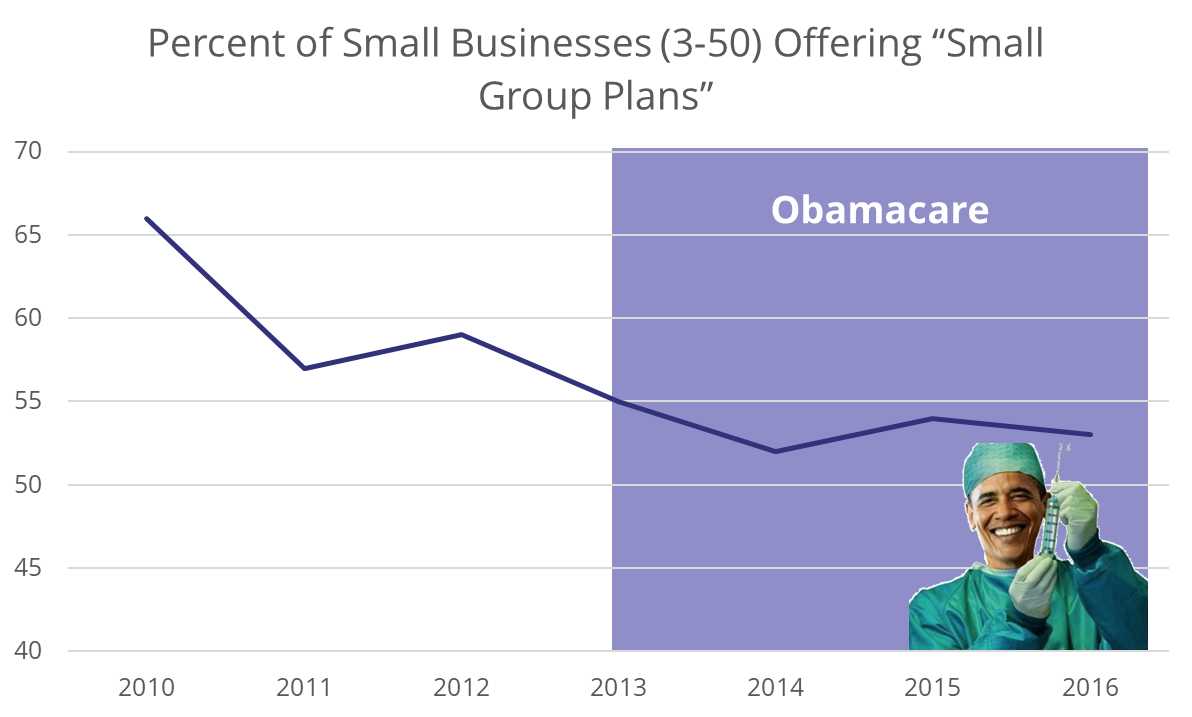

Traditional small group plan premiums have gone up an average of 30% over the last few years. When we surveyed business owners, they mentioned they felt “hopeless” and “frustrated” at this expense that was out of their control and always going up. In many states ,the minimum contribution required to maintain a group plan is up to $400/mo per employee. In fact, you can see employers have been dumping their group plans and according to KFF, the largest reason is cost:

This is where QSEHRA is truly a game-changer. Employers can set how much they want to contribute (up to the maximum amounts, discussed later) and there are never any increases unless the employer wants to increase the amount. QSEHRA is a much more budget friendly solution for small businesses and non-profits.

Is QSEHRA right for your company or client?

QSEHRA PROS & CONS

Pros and Cons of QSEHRA

Wondering what the pros and cons of QSEHRAs are?

QSEHRA pros and cons are critical to consider if you are assessing whether a QSEHRA is right for your small business.

| QSEHRA Pros | QSEHRA Cons |

|---|---|

Roughly 80% of our small business clients are net new to benefits, meaning that QSEHRA is allowing them to help their employees with health insurance costs for the first time, even though they aren't required by law. This is great for everyone! |

Only companies with fewer than 50 full-time employees may participate. |

Small businesses can set a budget that works for them without the fear or renewal hikes or increasing costs. |

QSEHRA cannot be offered with a group plan. |

Everyone knows benefits are super important for hiring and retaining the best talent. QSEHRA health insurance is a great way for small businesses to extend this offer to employees. |

Owner eligibility for QSEHRA depends on how your business is set up. That means in some circumstances owners are not eligible to participate in a small business HRA. |

The simplicity of QSEHRA will allow you to spend your time where it should be— focused on running your business. Since you are offering a fixed amount per month, there’s no need to spend time & mental energy trying to implement wellness programs & manage your employees’ healthcare spend to control your costs on a traditional group health plan. The right QSEHRA administration platform can make this super simple. |

There are reimbursement limits set by the IRS. Annual allowance limits go up slightly every year along with inflation. For an HRA without these limits, consider an ICHRA. |

QSEHRA allows tax-free reimbursements for premiums and qualified medical expenses (if allowed by the QSEHRA plan design). |

Premiums only and premiums + medical expenses are the only two options for reimbursement. Medical expenses only is not an option. |

Employees can shop the plan on the individual market that best meets their needs. If one employee prefers their Aetna plan, no problem. If another would like a BlueCross plan because the network includes his preferred doctors, that’s great too! |

Some areas are better for QSEHRAs than others, depending on how competitive and affordable the options are in the individual health insurance market. To see how it is in your location, check out our Qualified Small Employer HRA Heat Map tool. |

This is a big one! With QSEHRA, when a company enrolls, employees are eligible for special enrollment, which means they can shop for a major medical plan on the individual market at that time (and outside of the typical open enrollment timeframe). |

|

Unlike the individual coverage HRA, QSEHRAs can integrate with sharing ministries (if accompanied by a MEC plan), TRICARE, and spousal plan premiums. For employers, QSEHRA plans can be changed throughout the year. |

|

If an employee leaves your company, they won't lose their health plan. |

Roughly 80% of our small business clients are net new to benefits, meaning that QSEHRA is allowing them to help their employees with health insurance costs for the first time, even though they aren't required by law.

Client Spotlight: An IT Consultant Opts for QSEHRA

QSEHRA Requirements for 2025

Employer Requirements for QSEHRAs

To use a QSEHRA, a small business or non-profit must meet two primary requirements:

- Be “small”: The business or non-profit must be a “small employer” in the eyes of the IRS with less than 50 full-time employees (defined in IRS section 4980H(c)2).

- Not have a group health plan: The small business or non-profit cannot have a traditional group health plan (defined in IRS section 5000(b)). This makes sense—the purpose of a QSEHRA is to reimburse for individual health insurance, so a business cannot have a group health plan at the same time. This restriction does not apply to non-health group benefits like life insurance or disability insurance.

If your business currently has a group health plan and wants to change to a QSEHRA, you can cancel the group plan at anytime. You don’t have to wait until the end of the year or an enrollment period.

Employee Requirements for QSEHRAs

To receive tax-free reimbursements from a QSEHRA, an employee must:

- Be covered by an insurance plan: Employees can be covered by their spouse’s plan, their parent’s plan or purchase their own individual insurance plan. Plans must provide Minimum Essential Coverage (MEC) as defined by the IRS in Section 106(g). MEC plans include major medical plans, Medicare, Medicaid, etc. Faith-based sharing ministries, short-term plans, and indemnity plans are not MEC but may be able to be supplemented with a MEC offering in order to qualify. *Employees offered QSEHRA qualify for a Special Enrollment Period (SEP) which will allow them 60 days to purchase qualifying plans from the individual marketplace outside of Open Enrollment. This makes finding a plan easier for employees!*

- Submit a claim for reimbursement: This may seem obvious but often gets overlooked! Employees have to prove they spent money on an eligible health expense before they can be reimbursed.

In addition, it’s worth noting that an eligible employee must also actually be an employee of the sponsoring employer. In 99% of cases, this means someone that receives a W-2 from the company. Retirees of the company, friends of the company, contractors, and owners that are not actually employees cannot participate.

Can Owners Participate in QSEHRA?

In order for small business owners to be able to participate in a QSEHRA, the owner must also be an employee of the business. Employee status for owners is often determined by the corporate structure of the business.

A good rule-of-thumb when determining owner eligibility is if an owner receives a W-2, he or she is likely also an employee and can participate. A W-2 isn’t fool-proof though. If you’re not sure, always verify with your licensed tax professional.

Even if an owner can’t participate and receive tax-free distributions from a QSEHRA, there may still be some benefit in tracking his or her expenses because some owners will qualify as self-employed and can deduct health insurance on their personal tax returns anyways.

Designing your QSEHRA for maximum efficiency

Understanding the rules as well as the design options can help you design your QSEHRA to achieve what you want--creating an awesome employee benefit without losing control of the budget. Let's jump in!

QSEHRA Reimbursement Rates

In general, employers have a lot of flexibility with how they design and implement a QSEHRA. An overarching rule though is that employees must be treated fairly. That means you can’t offer some employees more money than others unless they can be fairly separated using the design criteria below. The IRS calls this “same terms requirements” and provides details in Section C of IRS Notice 2017-67.

All reimbursements are subject to annual maximums and become available to employees on a monthly basis. This means employees can’t take the full annual amount in January—instead, the funds become available to employees each month. Here are the maximum contribution amounts and what they translate to on a monthly basis:

| 2024 | 2025 | |||

|---|---|---|---|---|

| Single | Family | Single | Family | |

| Annual | $6,150 | $12,450 | $6,350 | $12,800 |

| Monthly | $512.50 | $1,037.50 | $529.16 | $1,066.66 |

Table 2: QSEHRA Reimbursement Rates for 2024 and 2025

In the law, these amounts are tied to inflation, so we expect them to go up a little bit every year.

If an employee joins the company or becomes eligible to participate in the middle of the year, the employee is eligible for a prorated amount based on the month they became eligible. For example: John joins ACME Corp in October and is immediately eligible for ACME’s QSEHRA (no waiting period). For math’s sake, let’s say ACME reimburses $200/mo ($2,400 annually). John is eligible for 3 months (October, November, December) and therefore can receive up $600 for that plan year.

Two other key points:

- Unclaimed funds stay with the employer. If an employee is not eligible or does not make a claim in a given plan year, the employer keeps the money.

- Funded solely by the employer. This makes sense when you think about it because QSEHRA is a reimbursement of expenses the employee is paying out of pocket. This can be a little confusing at first for small business owners that had traditional group health plans in the past and would deduct employee contributions on the employee’s paycheck. Just to be clear though—employees cannot contribute to a QSEHRA (they would just pay out of their own pocket).

Although employees cannot contribute to a QSEHRA, employers can consider adjustments to employee base salaries to account for the reimbursement allowance. This is not recommended for most teams (it’s a bit sensitive telling employees you’re reducing their salaries) but in cases where employees are already paying for insurance out of their own pocket and the employer cannot afford to give more, we’ve seen this work. The tax savings will likely result in everyone taking home more money.

Reimbursement Design and Flexibility

Ok, those are the rules—now let’s look at how awesome and flexible a QSEHRA can be! Being smart and savvy during the setup is the key to unlocking greater savings and efficiencies over other health insurance options. Here are the design choices employers can make when establishing their plan:

How much to reimburse: Employers have a few options on setting reimbursement rates. The key is rates have to be offered fairly to all eligible employees. Here are the most common tried and true methods we see:

- Reimburse all the same amount. This is pretty simple. Just pick a rate up to the individual maximum to give all employees.

(Example: all employees get $300/mo) - Reimburse all the maximum amount. Give all employees the maximum amount they are eligible for under the “single” or “family” categories.

(Example: for 2025 all single employees would get $529/mo and all employees with dependents would get $1,066/mo.) - Reimburse different amounts based on family size. Employers can set different rates based on an employee’s dependents. The IRS requires that employers choose a reference plan or offer a fair percentage of the maximum.

(Example: Single employees get $200/mo, married employees get $400/mo, and employees with families get $600/mo)

Need help designing your QSEHRA, finding a reference plan, or choosing an appropriate reimbursement rate? Chat with us! Our team can help you benchmark against similar employers in your industry as well as look at the individual market options in your location so you can save money but still offer a great, competitive benefit.

What to reimburse: Employers have a lot of flexibility over what is reimbursed. Understanding the impact of these options can go a long way towards helping the employer achieve their objectives and keep their budget in check.

Here are a few choices employers can make:

- Reimburse Insurance Premiums Only: Employers can limit reimbursements to only go towards eligible premium expenses. Typically, this refers to individual health insurance premiums but could also include eligible dental premiums, vision premiums, etc. as long as the employee has Minimum Essential Coverage (MEC) (see notes on employee eligibility above).

- Reimburse Insurance Premiums and Medical Expenses: Most employers choose to allow medical expenses to be reimbursed too. The list of eligible medical expenses is very long and comes from IRS Publication 502. Eligible expenses include doctor visits, copays, dental cleanings, prescriptions, eye glasses, diabetes supplies, etc. Note: Employers can choose to exclude categories of expenses (i.e., “prescriptions”) as long as the exclusion is applied fairly to everyone.

- Premiums of employees on their spouse’s group plan: Many small business and non-profit employees have access to traditional group health insurance plans through their spouse. This is great because it takes the primary insurance burden off of the small employer! However, employees may still have to pay something to participate in their spouse’s plan (usually a deduction on the spouse’s paycheck). Employers setting up a QSEHRA can choose whether or not to allow employees to make claims for these group plan premiums. Note: In most cases, these claims will be taxable to the employee because the spouse is likely making a payroll deduction on a pre-tax basis.

Understanding how these reimbursement options will impact your team is key to maximizing your QSEHRA’s efficiency. For instance, excluding medical expenses and premiums of spouse plans has the effect of only allowing reimbursements for employees purchasing their own insurance. This could be an effective strategy if you only need to help a few key employees or control your budget.

Which employees to reimburse: Wait, what? Don’t I have to treat everyone fairly? Yes, but there are some exceptions. While all full-time employees must be included, employers can choose whether to include or exclude:

- Part-Time employees

- Seasonal employees

- Employees under 25 years old (at start of QSEHRA plan year)

What to do with unused funds: During the year, unused balances will roll-over month-to-month for each employee. But what do you do with a remaining balance at the end of the year? Employers have the option to reset the balance to zero (recommended) or carry-over the funds to the next plan year. Note: Employee reimbursements cannot exceed the annual maximum in a given year even if carry-over amounts raise the balance above the maximum.

QSEHRA and Premium Tax Credits

What happens to premium tax credits with a QSEHRA?

If you have employees that would qualify for large tax credits on the individual market, QSEHRA may not be a good fit unless you can design around these individuals. The reason is government tax credits and QSEHRA reimbursements don’t stack, they offset. For example, if Frank would be eligible to receive a $300/mo tax credit from the government based on his household size and income but his company provides him $100/mo through a QSEHRA, then Frank’s tax credit will be reduced by the reimbursement amount down to $200/mo. In general, as an employer you don’t want to pay money that Uncle Sam would pay otherwise.

Some amount of tax credits are OK (up to a few hundred dollars per employee) as the pre-tax savings can outweigh the credit loss for the company and employee. However, if a few employees receive large tax credits, to optimize in this situation you’ll want to design your plan in a compliant manner to try to isolate these employees exclude them using the criteria above or offer a lower reimbursement amount. These employees will still have money to shop with for health insurance so you’re not disadvantaging them, it’ll just come from the government and not your business or non-profit. Alternatively, if your employees are willing to consider non-marketplace alternative plans that are not tax credit eligible anyway, QSEHRA can still be very advantageous.

Rule of Thumb: In general, if your employees’ average tax credit amount is less than ~30% of the reimbursement you’re offering, QSEHRA’s pre-tax savings will still win out. If not, QSEHRA may not be a good fit for your organization. If you’re not sure, you can contact us and we’re happy to help run-the-numbers for you!

Important note: Employees with tax-credits can’t opt-out of the QSEHRA and still receive credits. Their eligibility for tax credits is based on the reimbursement amount offered to them, not actually received.

Is QSEHRA right for my business?

We've put together a list of questions you can ask to see if a QSEHRA is right for your business.

- Do you lack the time and bandwidth to manage the administrative burden?

- Do you want to take care of your employees?

- Do you want to boost retention and recruitment in a tight labor market?

- Are you growing?

- Are you looking to save on taxes?

- Are traditional health plans cost prohibitive for you?

- Are you an international company with US workers that doesn't want to deal with the US health system?

- Are you having issues extending coverage to remote workers?

If the answer is yes to some of the above, it's worth having a conversation. QSEHRA solves for all of those common pain points.

Streamline your benefits management. Switch to a hassle-free HRA plan!

Step-by-step instructions to setup a QSEHRA

How to set up a QSEHRA

If a QSEHRA sounds like the benefit solution you need, how do you get started? Setting one up is pretty straight-forward. Here’s what you need to do:

- Design your reimbursement plan

- Create your legal plan documents

- Set a start date and cancel any group health policies (if applicable)

- Provide required notices to your employees

Step 1: Design your reimbursement plan

We covered the ins and out of reimbursement rates and requirements in the previous sections. Now it’s time to put it all together and design your reimbursement plan to achieve what you want. This is where working with an experience partner (like Take Command or, we admit, some of our competitors) can really help. Generally, we’re able to help employers come up a solution that fits their budget and needs.

Step 2: Create your legal plan documents

Do I really need plan documents or can I “just do it”?

We get asked regularly if an employer actually needs plan documents in place or if they can just administer a QSEHRA without a plan. Plan documents are not only a good idea, they are actually required. But that doesn’t mean they have to be overly complicated or expensive. Please don’t pay an attorney $1000s of dollars to draft plan documents for you. There are plenty of great off-the-shelf options. At Take Command, we set up plan documents for our clients for free.

Step 3: Set a start date and cancel any group health policies (if applicable)

Choosing a start date should be fairly easy, but there are some important timing issues employers will want to be aware of. The biggest timing factor is Open Enrollment for individual health plans which runs from November 1st to December 15th in most states. Some states have a longer Open Enrollment period but December 15th is typically the deadline for individuals to purchase a health plan that will start on January 1st of the following year.

During Open Enrollment, we recommend getting your QSEHRA setup a few weeks before the actual start date so that your employees have time to understand the benefits and choose a health plan that fits their needs. If you’re starting during the year, starting it as soon as possible will help you and your employees capture maximum tax savings.

Step 4: Provide required notices to your employees

Finally, you have to notify your employees about the start of the plan described in IRS Section 9831(d)(4). This is important because the QSEHRA could impact how they file their personal income tax returns, their eligibility for advanced premium tax credits on a federal marketplace, and will likely impact their choice of health insurance plans and coverage. IRS Section 6652(o) provides a penalty of $50 per employee for employers that fail to provide proper written notice. Yikes!

Written notice must be provided to employees as soon as they are eligible to participate and 90 days before the beginning of each plan year. We talk to many clients who see the 90 day requirement and think they have to delay the start 90 days. This is not the case. If you’re offering a new QSEHRA, then all of your employees are newly eligible and you can provide notices as of their eligibility date (i.e., when the plan is set to start).

Employee notices are required to have the following information (see IRS Notice 2017-67 Q38 for more details):

- The amount of each permitted benefit for which the employee might be eligible

- A notice that employees must inform any health insurance marketplace (federal or state) about the plan in the event the employee is eligible for premium tax credits

- A reminder that employees must maintain minimum essential coverage (MEC) to participate and receive tax-free reimbursements

You’ll want to include your employee notices in new employee packets and keep records that employees received the notice in a timely manner. For employers that opt to use the Take Command platform, we automatically generate these notices and keep records for you.

Alright, once you get through Step 4, your QSEHRA is officially launched! Now you’ll want to turn to some resources to make sure it’s running smoothly and staying compliant. We’ll discuss administration and compliance in the next chapter (Hint: You really need a trusted third-party to help you here).

QSEHRA Administration and Staying Compliant

Once your QSEHRA is setup and running, there are a few things you need to do to administer it properly and remain compliant:

- Verify employee eligibility and MEC maintenance

- Reimburse claims when submitted

- File form 720 and pay the Patient-Centered Outcomes Research Trust Fund (PCORI) fee for each plan year (deadline: July 31)

- Provide a plan renewal notice if continuing the plan (deadline: 90 days before end of year)

- Keep records

QSEHRA Administration 101

The above administration requirements are not hard, but they can get very tedious for small business employers. It’s important to stay compliant though or the IRS could deem your QSEHRA to be invalid and all of your reimbursements to be taxable (for both you and your employees) as outlined in IRS Notice 2017-67. Yikes.

Can I administer my own QSEHRA?

We often get asked by small business owners: “Can I administer my own QSEHRA?” The short answer is no. Let’s talk about why employers will run into trouble completing the above steps on their own and why experts strongly recommend a third-party to help.

There are 3 primary reasons you should not self-administer your plan:

- Privacy – This is the big one. For reimbursements to be tax-free, you have to substantiate that employees are using it to pay for health insurance and medical expenses. You can just have employees submit receipts to you, right? Well, the catch is information about your employees’ medical expenses (including individual insurance premiums) is considered Protected Health Information (PHI) under the Health Insurance Portability and Accountability Act of 1996 (HIPAA). As an employer, asking for employee medical records is a HIPAA privacy violation. Plus, it can get awkward for your employees to disclose personal medical information to their boss.

- Record Keeping – The IRS requires small businesses to keep records up to 7 years. That means you’ll need a secure way to keep your employees’ medical receipts and their PHI secure and safe for up to 7 years. The ole’ stick receipts in a shoebox idea probably isn’t a good one here.

- Changing Regulations – In case you haven’t noticed, healthcare policy is constantly changing. QSEHRA is new and evolving. In it’s first year of existence, it has already had two major guidance changes issued by the IRS (here’s one and two) with more promised on the horizon. Do you really want to keep up with that yourself?

QSEHRA FAQs & Additional Resources

We hope this guide has been helpful for you! We want to remind you again that we are not licensed tax professionals, please don’t construe the information we’ve provided as official tax advice.

Yes, contribution amounts can be changed during the year with a 90 day notice required. While you can adjust the contribution amounts during the year, we recommend changing at the end of the year when your employees will be able to change plans during open enrollment (Nov-Dec 15).

HRA stands for Health Reimbursement Arrangement (not account). You are not required to set up a separate bank account to manage the HRA. Larger companies may find it easier to run the HRA through a special dedicated account though.

To remain compliant, the HRA must be made available in a fair manner to your employees. You can vary rates based on employee stats (full-time vs part-time), employee age, or family status (single, couple, or family). As long as everyone that fits the criteria you set is treated fairly, you are good to go.

Part-time, contractors, and seasonal workers can be excluded or reimbursed at a different rate.

If you're interested in offering different amounts to different types of employees (like salary vs, hourly) check out the Individual Coverage HRA (ICHRA), which allows you to do that.

Nope! There are many things to like about small business HRA’s but not having extra taxes to pay are definite perks!

If you’re looking for more information, we recommend you check-out our Frequently Asked Questions (FAQ) database on QSEHRA. We’re always learning and adding to this database:

Getting started: What's reimbursable? When can a plan start? Do I have to include everyone? +more

Managing a plan: How to handle onboarding, participation, reimbursements, changes... +more

Reporting: What's required on my employees' W-2 form? What if an employee leaves? +more

Logistics: What's proof of coverage? How do I submit a claim? What if I exceed my allowance? +more

You can also find helpful resources and articles on our blog's QSEHRA topic page.

Finally, please don't be a stranger! We'd love to meet you.

Note: This QSEHRA Guide was originally published in 2017 and has been updated for 2025 with the latest data and regulatory changes.

About the Author: Hi, I'm Jack and I wrote this guide to help you make the most of your QSEHRA reimbursements. I had a lot of help from my team and our attorney too!

As a licensed health professional and leading QSEHRA expert, I've been published in the New York Times, Wall Street Journal, Forbes, and others on helping small employers realize the potential of QSEHRA. I am a small business owner and have an MBA from Wharton.

If you have any questions, please chat with me or my team or fill out the form below. Thanks for reading!