We've updated this post with 2022 individual insurance information for Atlanta. Check it out here.

Did you know that the uninsured percentage in Georgia is above the national average with 13.9% uninsured, totalling 1,388,000? In fact, Georgia is the 8th most populous state and has the fourth highest number of uninsured! It doesn’t help that Georgians are faced with fewer carriers and premium increases that price many out of the market. However, there are still options available if you are looking for individual health insurance in Georgia and we have some great tips if you are in the market for a new plan.

How to Shop Smart

Did you know that over 88% of Americans choose the wrong health insurance plan and end up wasting over $500 a year on health expenses? Buying health insurance can certainly be overwhelming. Here are some tips on what to look for when shopping!

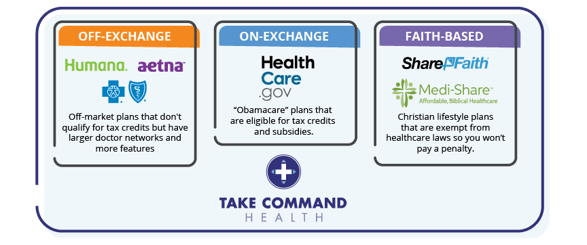

- Know your options There are several ways to purchase health insurance in Georgia. When you shop at Healthcare.gov, you’re only seeing “on-exchange” plans. However, insurance companies only make a fraction of their plans available “on exchange.” If you go directly to an insurance company’s website, you’ll see their “off-exchange” plans. There are also private exchanges, co-ops, and even faith-based “medical sharing” plans that function similar to insurance. But it is time consuming to go to individual websites, and how do you know you are comparing the same plan types? Take Command Health can help you quickly see ALL of your options. We have plans from all the major carriers that you’ll find “on exchange”, many of their “off exchange” plans, and even the faith-based plans like Medi-Share.

- Know your doctor preferences. In 2017, doctor networks are becoming more “narrow,” especially in Georgia. This means that “in network” is going to be more important as insurance companies are going to pay less and less if you see an out-of-network provider (unless it’s an emergency, of course). Most people know about PPOs and HMOs, but there are some other in-between options a savvy shopper should know about.

Being “flexible” with which doctors you see is a huge savings opportunity. If you don’t have many preferred doctors, consider an HMO. These are not the HMOs of the past, you still get coverage for emergencies anywhere in the country and many companies offer referrals by phone or online.

If you have a lot of doctors you want to see or if you don’t want to have to get a referral to see a specialist, consider an EPO which are often cheaper and more readily available than PPOs are. At TakeCommandHealth.com, we have a first-of-its-kind universal doctor search tool. Search for your favorite Georgia doctors and we’ll tell you which networks and plans they accept.

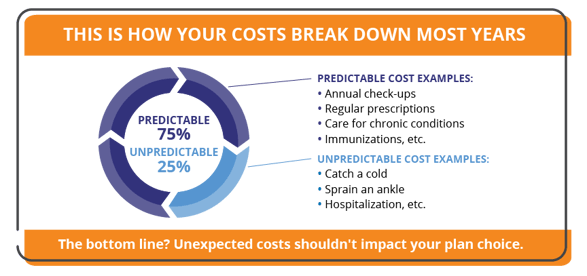

- Estimate your out-of-pocket costs. Yes, this is possible and it is critical to choosing the right plan! Statistically, over 75% of your costs in the next year are predictable based on your known needs. What really drives costs, and therefore your plan choice, are the things you know about: prescriptions, doctor visits, therapy, medical equipment, etc. If you’re healthy, maybe you plan on none of these things–which is just as important to know too. So which plan will cover your known needs the best and minimize your out-of-pocket expenses?

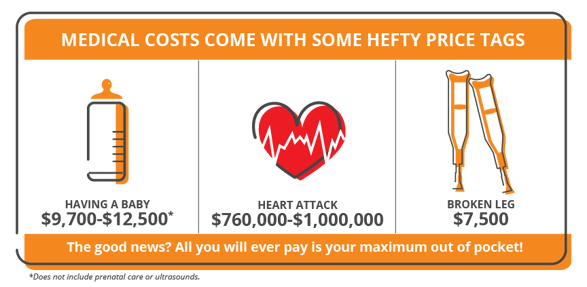

At TakeCommandHealth.com, we’ve read all the fine print on deductibles, co-pays, and coinsurance for you. You can quickly search for your prescriptions or tell us about any health needs you are managing such as “physical therapy” or “having a baby.” We’ll run all the numbers for you and help you estimate your out-of-pocket costs on each plan!

At TakeCommandHealth.com, we’ve read all the fine print on deductibles, co-pays, and coinsurance for you. You can quickly search for your prescriptions or tell us about any health needs you are managing such as “physical therapy” or “having a baby.” We’ll run all the numbers for you and help you estimate your out-of-pocket costs on each plan!

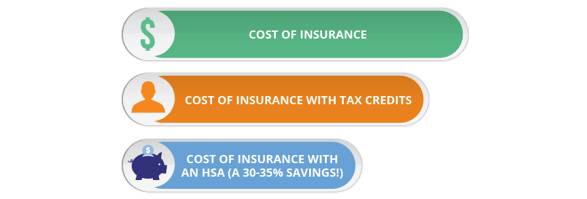

- Take advantage of tax credits! One way to pay too much for health insurance is to leave money on the table. We see many individuals assume they're not eligible for tax credits when they actually are. Depending on where you live, a family of 3 or 4 that makes $90,000 a year will likely qualify for a tax credit. This means there is a good chance a tax credit is waiting for you! At TakeCommandHealth.com, we’ll help you quickly determine if you’re eligible for tax credits and automatically apply them to your plan each month without the hassle of Healthcare.gov.

-

Utilize savings memberships to reduce overall costs! High deductible plans are increasingly the norm, but they tend to dissuade the user from seeking medical care when needed. What if there was a way to still get medical care but at a reduced cost? Take Command Health Premier Membership offers pharmacy and dental discounts, free telemedicine, and bill negotiation. Did you know that up to 80% of medical bills contain errors, costing consumers over $17 billion! The premier membership plan supplements your health insurance and helps you save money every time you use it!

Next steps

If you're looking to get individual health insurance in Georgia that'll help you and your family save money but don't want to spend forever digging around the fine-print from health insurance companies or waiting on hold with Healthcare.gov, we would love for you to try our free service. We'll walk you through a short online interview to help you discover all of your options, search for your doctors and prescriptions, and even help you simulate conditions. We'll then recommend the plan that we think will minimize your total costs over the course of the year. It's free to try and only takes a few minutes. Click the button below to get started!

Let's talk through your HRA questions

I wrote this blog because I love helping people decode confusing insurance jargon and understand the fine print. I'm a licensed health insurance professional and specialize in simplifying health insurance for individuals and small businesses. My QSEHRA articles have been featured regularly on Accounting Today, Accounting Web, HRWeb, and other industry publications. I'm also a member of Take Command Health's client success team and a full-time mom. Learn more about me and connect with me on our about us page. Thanks!