As an authority in small business HRA solutions and an advocate for small businesses and startups alike, we are excited to announce that following a record-breaking open enrollment period, we submitted our comments to the HHS, IRS, and Treasury last week regarding the latest proposed HRA regulations. Along with our comments were case studies and proprietary research we've put together from our experience with more than 800 small business clients to help boost individual HRA adoption.

We believe the proposed rules, if finalized, present a great opportunity to provide employers additional flexibility to assist employees with health coverage. We have seen first-hand how the HRA approach promotes consumer choice and market competition and we believe these proposed rules will also help return healthy risk to the individual market.

However, we’ve also seen first-hand how some employers that genuinely want to help their employees hit unexpected roadblocks and how others try to game the rules to discriminate unfairly. We shared our experience, data, and case studies with CMS to assist them as they finalize the rules.

As the only QSEHRA administrator also licensed as an individual health insurance broker, we bring a unique perspective.

Our shared insights will offer value to CMS as they consider what comes next for small business HRAs. Understanding the implications from an individual point of view and the employer standpoint is vital to arriving at a viable solution.

But before we jump in to our comments, let's start with a recap.

What are the new HRA regulations all about?

In October 2018, the U.S. Departments of the Treasury, Health and Human Services, and Labor proposed new regulations to expand the usability of health reimbursement arrangements (HRAs). This is the 3rd and final part of President Trump's Executive Order from October 2017 (E.O. 13813) to reform the health system through regulatory changes. You can see the press release, accompanying fact sheet, and proposed rule itself here.

The result of these proposed regulations means that starting in January 2020, employers will be able to offer not one but two new type of HRAs called "Individual Coverage HRAs" (aka ICHRA) and "Excepted Benefit HRAs" (EBHRA).

More recently, on November 19th, we received additional guidance and likely safe harbors as well as requests for comments. This information provides us a great glimpse into how these new HRAs may actually function (and this gets us so excited!).

Now that the comments period has closed, we expect finalized rules in the next few months.

How is ICHRA different from QSEHRA?

This is a big upgrade over QSEHRA, which allows employers to choose whether to include or exclude classes of employees similar to the list above but not to offer different offerings.

For example, under the proposed rules, employers could offer full-time employees a traditional group plan and part-time employees an Individual Coverage HRA. Or employers could offer an HRA with certain reimbursement rates to an office in one geography and a different HRA with different reimbursement amounts to an office in another location (based on the rating area criteria above).

Initial guidance and examples were provided in Notice 2018-88 as well as ideas on potential safe harbors for large employers (ALEs). These safe harbors are important to make Individual Coverage HRAs more practical and less administratively burdensome for large employers. The initial safe harbors include:

- Employee location: Allowing ALEs to base HRA rates based on their primary business location instead of every employee's actual address

- Calendar year and non-calendar years: Provisions for HRA plan years that are different from individual insurance plan years

- Affordability: Allowing ALEs to estimate an employee's Household wages using one of three different methods: Form W-2 Wages, Rate of Pay, or Federal Poverty Line.

Another safe harbor based on employee ages was also discussed but not yet provided. The IRS is asking for comments on how this might be practically implemented.

What we shared with CMS

It is a privilege to share our unique experience and perspectives from both the employer and employee sides, as a practitioner of small business HRAs and individual insurance to help accelerate the adoption of rules intended to give more freedom to HRAs.

Our insights are derived from what we have learned from the 800 employers we've helped with QSEHRA and 2,000+ qualified employers that were drawn to the idea but determined QSEHRA's rules made tax-free reimbursement impractical.

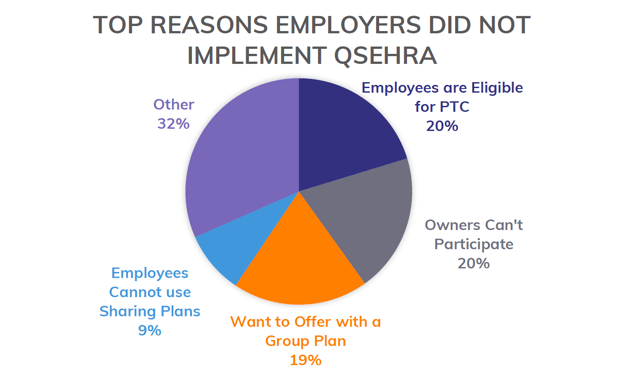

We’ve tracked the reasons these employers were not able to implement a QSEHRA and want to share some of their stories with you. The chart below provides a summary of the reasons otherwise qualified employers were not able to implement a QSEHRA:

As you can see in the chart, the main reasons that QSEHRA wasn't a good fit were:

- Employees are eligible for PTCs.

- Owner's can't participate.

- Employer wants to offer a group plan.

- Employees cannot use QSEHRA with sharing plans like Medi-Share.

Let's jump a little deeper into these common hurdles. The good news is that many of these issues can be solved by simple, common-sense modifications to the current system.

How Premium Tax Credits get in the way of tax-free reimbursement

As it stands now, an employer that merely offers a QSEHRA reduces available premium tax credits (“PTC”) for employees eligible to receive a PTC. Employees are also prohibited from “opting out” from QSEHRA. As a result, we’ve found in practice QSEHRA only works for employers that employ high-income professionals only.

This limits the applicability of QSEHRA, especially for employers that employ even a few middle-class or low-income employees. This represents a common roadblock—a business owner eager to help his or her employees becomes disincentivized when he or she realizes they are just replacing PTCs that would be available if they offered nothing.

The “opt-out” provisions provided in the proposed rules are a step in the right direction, but do not go far enough to help employees, especially middle-class and lower-income ones, that really would benefit from their company’s contributions. We worry this will severely curtail adoption of Individual Coverage HRAs if not addressed.

And that's not all. Employers also express frustration that their contributions cannot be used separately for medical expenses by employees receiving PTCs without offsetting the PTC. Many employees receiving PTCs through an Exchange could still use help to pay for medical expenses, especially with plan deductibles getting higher and higher each year.

Finally, we are often asked by employers if they can offer employees likely to receive PTC a taxable reimbursement that’s conditioned on the employee purchasing health insurance. Our understanding is this would trigger an Employer Payment Plan (“EPP”) under IRS Notice 2013-54 and be disallowed. In our experience, employers will forgo offering any type of benefit to employees or will proceed with the taxable reimbursement as a practical work-around.

To help Individual Coverage HRAs gain traction and be a viable solution for more employers, we strongly suggest that you consider permitting PTCs and HRA contributions be allowed to “stack” and for employees to be able to accept both on a pre-tax basis.

So how can this be fixed?

We're glad you asked.

- Allow employees to opt-out of the HRA and receive PTC even if the HRA is deemed “affordable.” This would be a great opportunity to help close the “family loophole” that has been problematic with the ACA.

- Allow Individual Coverage HRA contributions to help cover “qualified medical expenses only” or “excepted benefits only” for employees also receiving a PTC. This would also provide a consistent and parallel offering for Individual Coverage HRAs to what will soon be available for traditional group plans with the proposed Excepted Benefit HRAs.

- Allow employees receiving a PTC to accept an HRA contribution from an employer on a taxable basis allowed by the employer in the HRA’s plan documents. This approach would also be consistent with employees that are covered by their spouse’s group plan being eligible to receive taxable reimbursements under QSEHRA and Individual Coverage HRAs to help pay for unreimbursed premiums.

How employer participation affects QSEHRA viability

So many questions come in for owners of S Corps, Partnerships and other types of businesses wondering whether or not, as an owner, they can participate in QSEHRA. Many times, they are disappointed to learn that they, in fact, can't participate.

Here's a case study to help you understand this hurdle.

Consider a small dental practice with two dental partners and six employees. The practice is set up as an S-Corporation (very typical) and the owners currently offer a traditional small group health plan in which they both participate. However, the firm is having trouble maintaining the minimum required participation rates as several employees have better coverage options available through their spouses. Moving to a QSEHRA or Individual Coverage HRA makes sense from a benefits perspective, however, under the current QSEHRA rules the two partners would be unable to participate since they are S-Corp owners. Although they could take a self-employment tax deduction, it’s not as tax-efficient and a significant barrier to adoption to tell the partners they cannot participate in their new benefits plan.

We strongly suggest the finalized rules provide inclusion language regarding owner participation—particularly for S-Corp Owners, Partners in a Partnership, and others. This is justifiable because S-Corp owners and Partnership Partners can currently participate under group health insurance and even HRAs under Section 105 and just report their HRA contributions differently on their personal tax-forms. These same participation rules need to be explicitly extended to the new Individual Coverage HRAs and Excepted Benefit HRAs.

When group plans and QSEHRAs are mutually exclusive

This challenge usually happens when a small business has different classes of employees or when an employer owned multiple businesses.

For example, we had a 25-person private Day School for children that had a popular group plan for the 12-person full-time staff. The administration wanted to extend benefit coverage to the remaining 13 part-time employees although they could not afford to bring them onto the group plan. As a result, they sought out a QSEHRA to reimburse part-time employees $200/mo. Since QSEHRA does not allow employers to maintain small group coverage for any employees, it quickly fell apart.

We believe the new employee classes proposed in the new rules will solve some of these issues. As we understand in the new rules, this employer will be able to create new employee classes (full-time and part-time, for example) and implement the strategy they wanted to offer. We advocate the final rules also allow for additional employee classes.

The gray area when sharing ministries are used with QSEHRA

While health care sharing ministries like Medi-Share make up a small percentage of the overall insurance market, they are pervasive in the small employer space. When we meet with a 10-person company interested in setting up a QSEHRA, it’s highly likely at least 1-2 employees are using a sharing plan.

We need explicit guidance and rules on how to handle these plan types or it’s likely to trip up many employers considering Individual Coverage HRAs. Current guidelines on QSEHRA require that employees maintain Minimum Essential Coverage (MEC) in order to receive QSEHRA reimbursements. Sharing plans do not meet the MEC requirement but do exempt members from having to meet the MEC requirements.

We highly recommend the finalized rules allow as much flexibility as possible for innovative plan designs that can still meet minimum protection thresholds.

Other specific issues

CMS called for comments on several specific issues surrounding the ICHRA and EBHRA. Here's what we had to say.

On how an HRA could substantiate whether individual health coverage is subject to and compliant with PHS Act sections 2711 and 2713 (p.36):

- For the sake of individual employees who will be shopping on their own to purchase plans that qualify for their employer’s HRA, we support efforts to make compliant plans easy to identify

- We also support the suggested idea that issuers of non-marketplace plans be able to provide employees with information upon request that their plans are “Individual HRA Compliant”

On whether employers should be able to offer employees a choice between a traditional group health plan or an HRA integrated with individual health insurance coverage (p.38; Section II.A.2.a):

- While in general we’d advocate for as much flexibility as possible; however, it’s difficult to see how this would practically work if employees in the same employee class could choose between a traditional group health plan and an HRA with individual coverage

- We support offering one option to each employee class but providing as much flexibility to the classes as possible.

On whether employer size or employee class size should be considered in determining permissible classes of employees (p 41-42; Section II.A.2.b):

- No, we think employer size and employee class size should not be considered

Regarding the proposed employee classifications (p. 45; Section II.A.2.b):

- In our opinion, more employee classes will be needed in order to make Individual Coverage HRAs a viable option for many employers, especially Applicable Large Employers (“ALE”)

- We strongly advocate for classes based on employee role or title to be added

- We recommend the department add classes based on gradations of part-time employees and employee tenure

- We support allowing classifications based on more specific geographic locations such as address or zip code

Regarding integration with STLDI and other plan types (p. 57; Section II.A.8):

- We strongly advocate that “Health Care Sharing Ministries” (“Share Plans”) and other non-group coverage that qualifies for a Section 5000A exemption from the Minimum Essential Coverage (MEC) requirements be eligible to integrate with HRAs.

- We strongly advocate that other non-group plans that meet the requirements of PHS Act Sections 2711 and 2713, including STLDI, be eligible to integrate with the HRA.

Regarding the proposed Excepted Benefit HRA maximum of $1,800 per year (p. 63; Section II.B.2):

- We strongly advocate that the maximum limit be higher if the HRA covers dependents

Regarding QSEHRA and Individual Coverage HRAs triggering a Special Enrollment Event (p. 85; Section V.)

- We strongly support the proposed rules allowing for Special Enrollment for new HRAs or QSEHRAs or material changes to an HRA or QSEHRA.

Regarding the Applicability Date of January 1, 2020 (p. 85; Section IV.)

- We support this applicability date but would encourage consideration of an earlier implementation date as we believe our clients would benefit from the expansion of HRAs.

A few more ideas thrown in for good measure

We wanted to share a few practical ideas that will help improve adoption of Individual Coverage HRAs by more employers.

- The “90 Day” notice needs to be adjusted to realities of individual market. This notice requirement is a challenge in the individual insurance market.

- Create a catchy name or acronym to describe the HRAs

- Direct Primary Care (“DPC”) Integration

- Transition process from QSEHRA to Individual Coverage HRA

What comes next

Now that the comments period is over and we've laid all of our ideas out on the table, we will likely see the final rule and guidance issued a few months into 2019. The action won't happen until January 1st, 2020, when the new rules become effective. That means starting in Q4 2019, you can start setting these up for 2020.

We're eagerly watching for changes and updates and will keep you up to date as we learn more. While we wait to see how this all shakes out, check out our new ICHRA Guide for more information on its background, setup process, requirements, and rules.

You can read our thoughts on the finalized rules announced June 2019 here.

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!