Does your company provide dental insurance? Good for you—no need to read on. If they don’t or you are self-employed—and you fall into the category of those purchasing their own dental coverage—this article is for you. We hope it clears up a common misconception: dental insurance isn’t your only option. In fact, it is a really bad option, complete with sky high premiums that are higher than the out of pocket costs for routine appointments and inconvenient waiting periods that put coverage on hold while you suffer through a toothache. Let's review the difference between a discount dental plan vs dental insurance and how Take Command Health can help.

Dental insurance = pure snake oil

Conventional dental insurance is plagued with restrictions such as waiting periods, maximum limits, and exclusions to coverage—all of which make it extremely hard to get more value than what you pay into it. Because of this, dental insurance is really only logical if you don’t have to pay for it yourself, meaning it’s probably paid for by the company you work for.

Here's how the math breaks down. The average premium is around $50 per month, or $600 a year. Your cleanings may be covered for a $75 copay right away. With the average cleaning and routine checkup coming in around $160 on average, that doesn't make a lot of sense. If you need orthodontics, great! You've got to wait 24 months for that to be covered and then it caps at $1,500 for coverage. That means you paid $1,200 to only get a $1,500 benefit.

If you aren’t provided with dental coverage by an employer, there is some fine print you need to pay attention to before purchasing expensive dental insurance:

- Caps on major dental work. Most plans will have a cap of around $1,500 per year on procedures such as root canals, fillings, and crowns.

- Waiting periods are commonly around six months before an individual will be eligible for dental work such as fillings, but can be as long as 18 months for other procedures. This is to protect the policy plan from people signing up to take advantage of the coverage but then dropping their policy after work is completed.

Insider tip: If a broker is trying to sell you dental insurance on the individual market, consider it a red flag that they are ripping you off and stop working with them. They are typically paid 20-30% commissions on individual dental plans. so how can that be a good value for individuals?

The better option

If you have to purchase your own dental coverage then the best way to achieve maximum savings and benefits is a dental discount plan. You pay an annual premium that is much lower than the monthly premiums required by dental insurance and you gain access to a network of dental providers who offer reduced costs.

Will a dental discount plan really save me money?

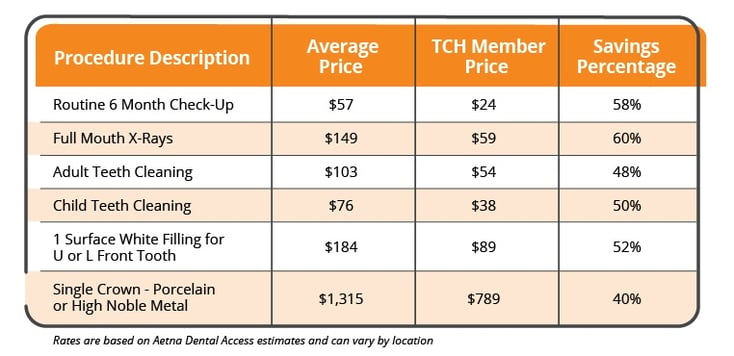

At Take Command Health we decided to investigate the true amount of savings you can get through a dental discount plan. And the good news is, we found a 65% average rate of savings!

Where do I sign up?

Enrolling in a dental discount plan just got easier with Take Command Health. Our Premier Membership Plan includes one of the largest dental networks through Aetna, and the cost is lower than purchasing the discount program with Aetna on your own. If your dentist happens to be out of network just let us know and we can send you information about additional discount dental plans!

Let's talk through your HRA questions

I wrote this blog because I care about ideas (big and little) that can help fix our healthcare system. I used to work on projects for Kaiser Permanente and the Parkland Health & Hospital System so I've seen the system inside and out. It's so important that consumers keep up with industry shifts and changing health insurance regulations. I'm also Take Command Health's Content Editor and a busy mom. Learn more about me and connect with me on our about us page. Thanks!